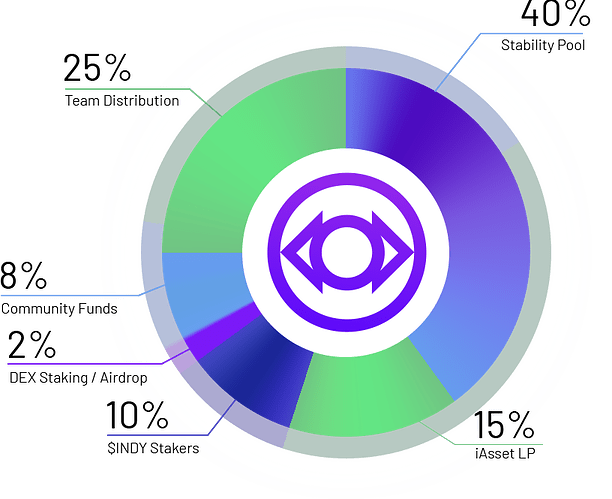

Indigo’s tokenomics currently is broken down into 6 terms:

- Stability Pool

- iAsset LP

- $INDY Stakers

- DEX Staking / Airdrop

- Community Funds

- Team Distribution

DEX Staking / Airdrop has since been renamed to Initial Token Distribution (ITD). Team Distribution is to be shortened Team. Community Funds is to be renamed to DAO Treasury.

Up for discussion is what other terms on the tokenomics chart should be renamed and which terminology choices could we use for Indigo’s features/capabilities.

This is not an official vote. This is a discussion to get input from the community about which phrases make the most sense. Voting doesn’t mean you’ll receive a reward of any kind. The vote result also doesn’t obligate the Indigo team to use the terminology proposed. There could be new terminology proposed in the future that makes even more sense and be more suitable to use.

Proposals x.1

Proposal 1.1: Stability

Stability. Stake your iAssets to an Indigo Stability Pool — earn INDY and liquidation rewards.

You stake iAssets to a Stability Pool because your iAssets are at risk of loss to maintain protocol stability in exchange for compensation. You’re now providing Stability and are rewarded via Stability distributions.

Proposal 2.1: Stability Incentives

Stability Incentives. Stake your iAssets to an Indigo Stability Pool — earn INDY and liquidation rewards.

You stake iAssets to a Stability Pool because your iAssets are at risk of loss to maintain protocol stability in exchange for compensation. You become a Stability Staker and are distributed Stability Incentives.

Proposal 3.1: Stability Rewards

Stability Rewards. Stake your iAssets to an Indigo Stability Pool — earn INDY and liquidation rewards.

You stake iAssets to a Stability Pool because your iAssets are at risk of loss to maintain protocol stability in exchange for compensation. You become a Stability Staker and are distributed Stability Rewards.

Proposal 4.1: Stability Stakers

Stability Staking. Stake your iAssets to an Indigo Stability Pool — earn INDY and liquidation rewards.

You stake iAssets to a Stability Pool because your iAssets are at risk of loss to maintain protocol stability in exchange for compensation. You become a Stability Staker and are rewarded via Stability Staking distributions.

Proposals x.2

Proposal 1.2: Liquidity

Liquidity. Provision iAssets as liquidity to a DEX — earn INDY as a reward.

You provision your iAssets to a DEX and either stake your LP tokens to a Liquidity Provider Pool or follow instructions for one of Indigo’s partnered DEXs. You’re now providing Liquidity and are rewarded via Liquidity distributions.

Proposal 2.2: Liquidity Incentives

Liquidity Incentives. Provision iAssets as liquidity to a DEX — earn INDY as a reward.

You provision your iAssets to a DEX and either stake your LP tokens to a Liquidity Provider Pool or follow instructions for one of Indigo’s partnered DEXs. You’re now providing Liquidity and are rewarded via Liquidity Incentives.

Proposal 3.2: Liquidity Proofers

Liquidity Proofing. Prove to an Indigo Liquidity Provider Pool that you’re providing iAssets as liquidity to a DEX — earn INDY as a reward.

You prove that you’re a DEX liquidity provider either by depositing DEX LP tokens to a Liquidity Provider Pool or following instructions for one of Indigo’s partnered DEXs. You become a Liquidity Proofer and are rewarded via Liquidity Proofing distributions.

Proposal 4.2: Liquidity Rewards

Liquidity Rewards. Provision iAssets as liquidity to a DEX — earn INDY as a reward.

You stake your iAssets to a DEX and either stake your LP tokens to a Liquidity Provider Pool or follow instructions for one of Indigo’s partnered DEXs. You’re now providing Liquidity and are rewarded via Liquidity Rewards.

Proposal 5.2: Liquidity Stakers

Liquidity Staking. Provision iAssets to a DEX and stake to an Indigo Liquidity Provider Pool — earn INDY as a reward.

You stake your iAssets to a DEX liquidity pool and either stake your DEX LP tokens to a Liquidity Provider Pool or follow instructions for one of Indigo’s partnered DEXs. You become a Liquidity Staker and are rewarded via Liquidity Staking distributions.

Proposals x.3

Proposal 1.3: Governance

Governance. Vote on Governance proposals using your INDY — earn INDY as a reward plus your share of Indigo Protocol fees.

You stake your INDY to vote for or against Indigo Governance proposals. You’re now participating in Governance and are rewarded via Governance distributions.

Proposal 2.3: Governance Delegators

Governance Delegating. Delegate your INDY towards Indigo Governance proposals — earn INDY as a reward plus your share of Indigo Protocol fees.

You delegate your INDY to vote for or against Indigo Governance proposals. You become a Governance Delegator and are rewarded via Governance Delegating distributions.

Proposal 3.3: Governance Incentives

Governance Incentives. Vote on Governance proposals using your INDY — earn INDY as a reward plus your share of Indigo Protocol fees.

You stake your INDY to vote for or against Indigo Governance proposals. You’re now participating in Governance and are rewarded via Governance Incentives distributions.

Proposal 4.3: Governance Rewards

Governance Rewards. Vote on Governance proposals using your INDY — earn INDY as a reward plus your share of Indigo Protocol fees.

You stake your INDY to vote for or against Indigo Governance proposals. You’re now participating in Governance and are rewarded via Governance Rewards distributions.

Proposal 5.3: Governance Stakers

Governance Staking. Vote on Governance proposals using your staked INDY — earn INDY as a reward plus your share of Indigo Protocol fees.

You stake your INDY to vote for or against Indigo Governance proposals. You’re now a Governance Staker and are rewarded via Governance Staking distributions.