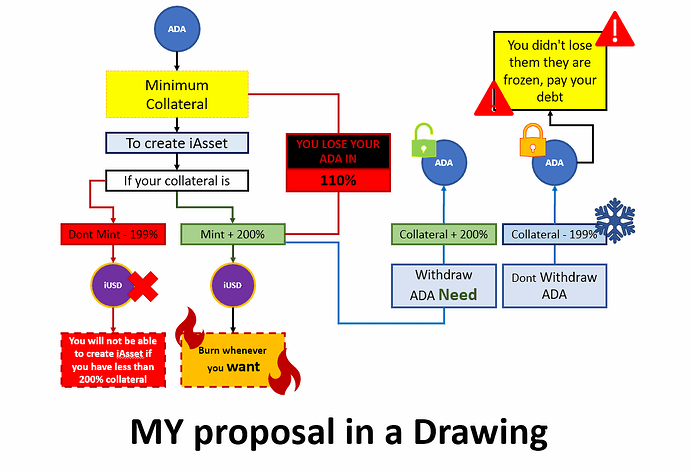

Given the circumstances of the bear market and the inexperience of many investors, the leveraged and other things, I propose something to protect all users and also the INDIGO coins.

Currently, the limit to request iAsset and be liquidated is 110%

Liquidity can be maintained, but here are the changes that I suggest.

1-To request iAsset the minimum requirement must be 200% or 250%, the same as Djed recommends, but instead of 400% it would be 200-250% with indigo, increasing the liquidity of Cardano blocking and limiting the creation of iAsset.

2-To withdraw Cardano from the liquidity of the loans, I suggest that it be the same as the above, that Cardano’s collateral remains above 200% or 250%, whatever the community chooses.

Example: if it were with 250% colaeral.

If the person who has debt in iUSD wants to withdraw Cardano from his iUSD collateral and it is at 190%, he has to return iUSD up to more than 250% to withdraw Cardano. Or if, on the contrary, she wants to request more iUSD and it is at 190%, she cannot request iUSD and she has to deposit more Cardano as collateral until she has more than 250%.

If it were with 200% the same but changing 250% for 200%

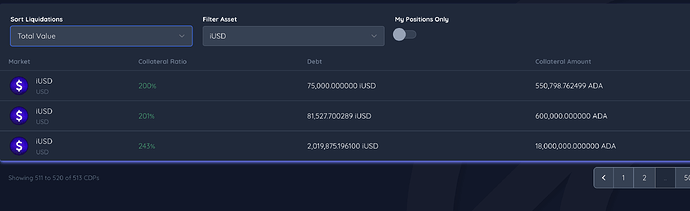

This would also protect against attacks against iAsset due to lack of liquidity, since it is only withdrawing Cardano having 110% to be liquidated and the whales can attack the price of the coins and the protocol. I see it as a vulnerability, and they have to think about that.

Settlements of 110% are not modified in this proposal.

All this to protect the inexperienced users to the leveraged ones.

Those who currently hold their iAsset would upgrade to the change to borrow and withdraw Cardano. That is to say that if they want more iUSD they have to add more Cardano, and if they want to withdraw Cardano they have to burn iUSD.