They can read the discussion at the following link, but first read what I will put here

“Before continuing, I’m not sure if it was due to the Google translator or what, but you misunderstood my proposal, and now I understand why there were attacks. Therefore, I had to use AI to explain it better to you. I clarify that I don’t have the intention of attacking the protocol, I just want to propose and discuss something. (I was secretly testing on Tesnet to prove my theory, but due to lack of liquidity and market trend change, I didn’t continue. The protocol justified that a bot was turned off, don’t think it is a vulnerability, but in case of a coordinated panic move, it may result in an unpayable CDP debt, leading the protocol to freeze funds or any other circumstance leading the limit to all users and the protocol. For example, look at the fall of the Cardano nodes, which fell by 50% in seconds and minutes, very similar to what happened with Solana (we will not discuss that here, experts let’s continue the discussion ).”

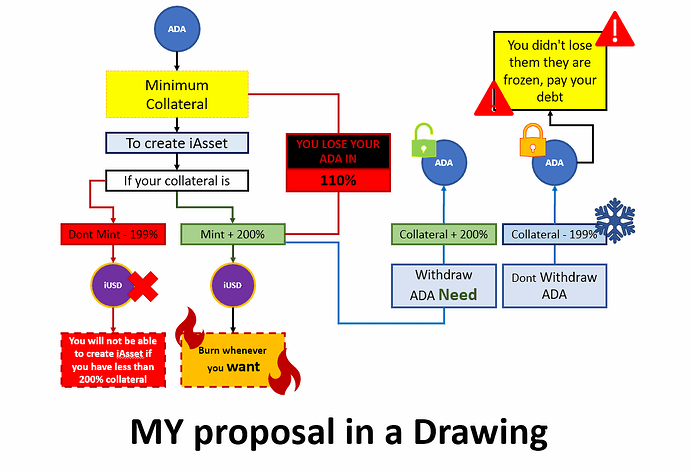

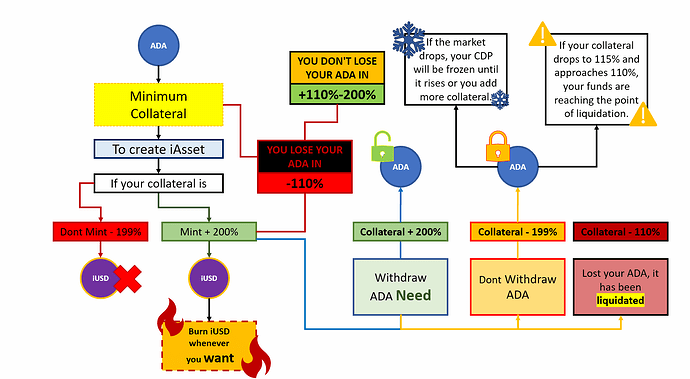

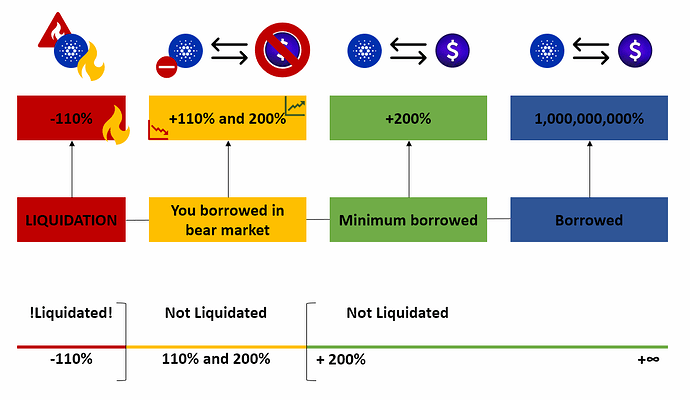

Therefore, before continuing, I ask that you look at the following images without reading anything I will write after them. If you believe your investment in a CDP will be liquidated between 110% and 200%, please review all images again.

Another protocol

Now, if you have understood the images, I congratulate you. If you have not understood that the idea is to have a minimum to create a 200% collateral and that the liquidation is 110%, then I recommend reviewing the images again until you understand.

I will leave one final image taken from DJED to explain what I wanted to show in my proposal, but do not take into account the reserve currency (meaning there is no Shen or any other reserve token), this is to explain as best as possible if you did not understand with drawings.

example:

1- 1. An investor deposits 1000 ADA as collateral to open a CDP. The current price of ADA is $1. The investor has a collateral ratio of 100%, meaning they have $1000 of collateral. The investor can borrow $900 in iUSD. If the price of ADA falls to $0.90, the investor’s collateral drops to $900, which is 100% of their iUSD loan, and their CDP is liquidated. Being below 110% means the investor loses all of their collateral funds.

2- 1. An investor deposits 2000 ADA as collateral to open a CDP. The current price of ADA is $1. The investor has a collateral ratio of 150%, meaning they have $3000 of collateral. The investor can borrow $900 in iUSD. If the price of ADA falls to $0.90, the investor’s collateral drops to $1800, which is 110% of their iUSD loan, and their CDP is not liquidated. Being between 110% and 200% means the investor keeps their collateral funds.

3- 1. An investor deposits 5000 ADA as collateral to open a CDP. The current price of ADA is $1. The investor has a collateral ratio of 250%, meaning they have $12500 of collateral. The investor can borrow $900 in iUSD. If the price of ADA falls to $0.90, the investor’s collateral drops to $2250, which is 250% of their iUSD loan, and their CDP is not liquidated. Having collateral ratio over 200% means the investor is protected even in an extreme bear market.

Having a minimum collateral ratio of 200% and liquidation ratio of 110% ensures that even in a bear market, investors will only lose their funds if their collateral falls below 110%. This protects the user from complete loss of funds in a bear market as the protocol only liquidates CDPs when collateral falls below 110%. Additionally, having a collateral ratio greater than 200% provides even more protection against loss of funds for the user.

I deeply apologize if my proposal was misunderstood. I was not suggesting to raise the collateral along with the liquidation rate to 120%. I do not agree with that idea and do not approve it. My intention was simply to ensure that users cannot borrow in an irresponsible manner.

I wanted to propose something similar to DJED but with autonomy for each of us. If some are not in agreement with the loan being greater than 200% due to self-liquidation, I respect that decision and that of the community. For me, 200% is the most responsible, but if the community votes for 150%, that’s fine for me and I agree. However, it is important that the liquidation rate always be at 110%. In the last protocol change, I thought that the detail of increasing the minimum collateral to 120% was not well explained, and when I started to be interested in the proposal, it seemed like a bad move for the users of Indigo with such a mediocre proposal in governance. Voted ONLY SAYING “minimum collateral-120%” Be more responsible and also explain the details of the new limits.

This is my last participation in the forum and I am writing this to clarify what I am proposing. If you do not agree, simply vote against it and do not create problems about it. I am a user like all of you, just writing in this forum. I ask the developers to delete my previous proposals as they have caused conflicts and discomfort among us. Finally, I will not participate in this protocol anymore.