This is a solution to the previous proposal that I developed:

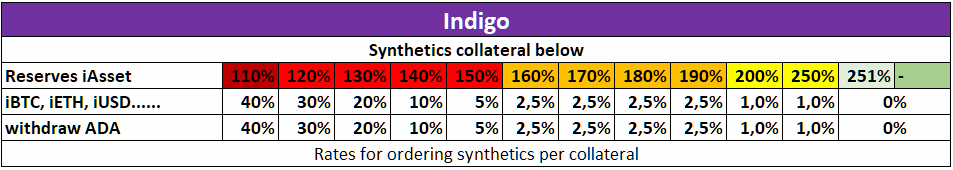

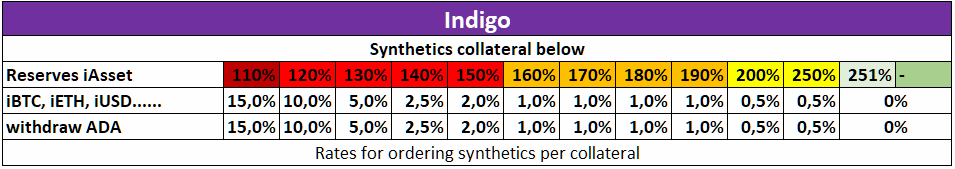

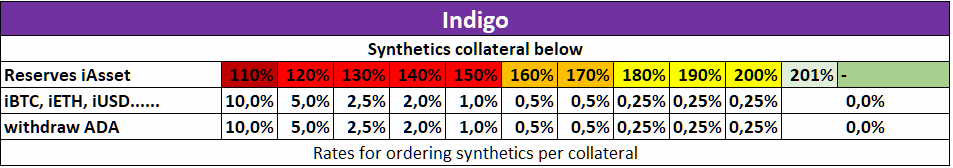

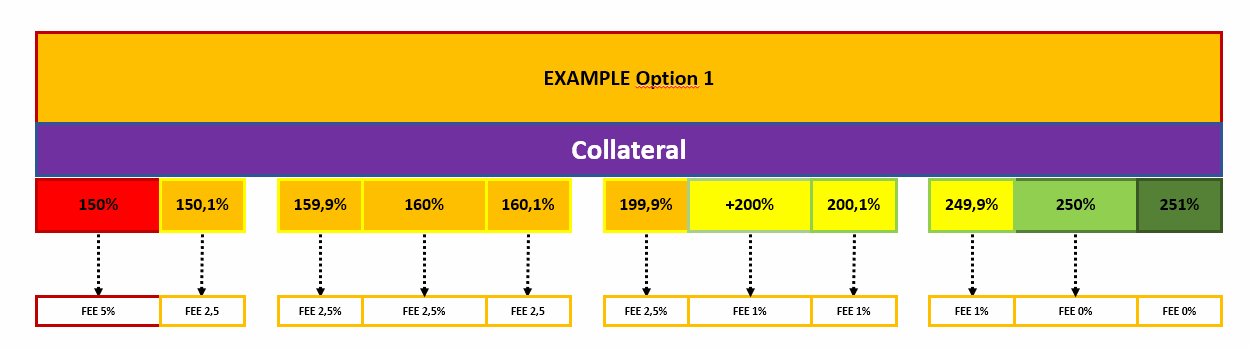

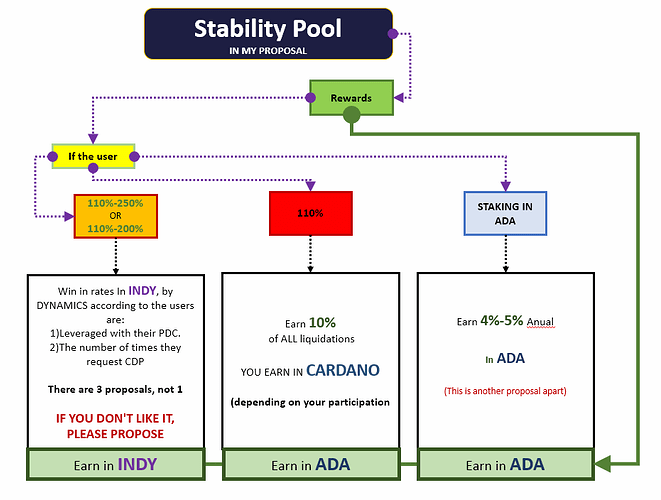

My previous proposal to limit synthetic token creation to 200% or 250% for responsible leverage was met with criticism, so today I propose something different that fits with those who think that self-leveraging is risky. Instead of limiting the creation of these CDPs, I propose the opposite. Similar protocols like JustStables have a 150% liquidation and minimum synthetic creation of 150%. Therefore, Indigo can do something truly different by reducing fees for Minting as the collateral moves away from 110%. For example, if I request a collateral of 200% to 250%, I would pay a 0.5% fee as a reward for those who have their reserves in the stability pool. If I request synthetic tokens using my collateral below 200% to 175%, I would pay a 2.5% fee. If the collateral is between 120% and 110% and I request synthetic tokens, the fee would be 10%. Burning would have no fees at any time, which would be an incentive for those who delegate their synthetic tokens to the stability pool. This way, we avoid excessive self-leveraging but it will always be available for those who want to do it. The limits would be determined by the users and how willing they are to leverage by paying a fee. However, I would request Indigo to reduce the minimum collateral from 120% to 110%. This proposal is open to discussion, improvement, and rejection, but ultimately it’s a solution that balances risk and reward for those interested in responsible leverage and improves confidence for those looking to invest like myself in the Indigo protocol.

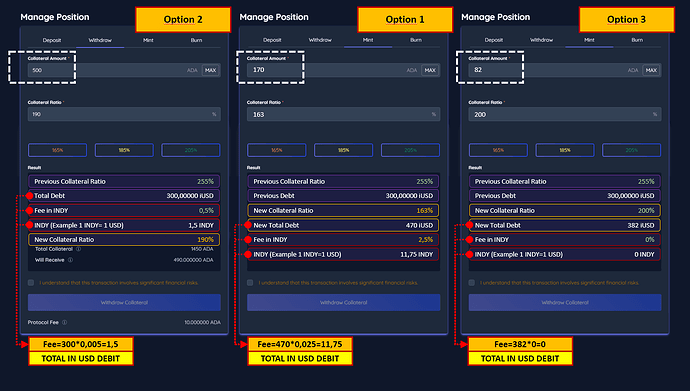

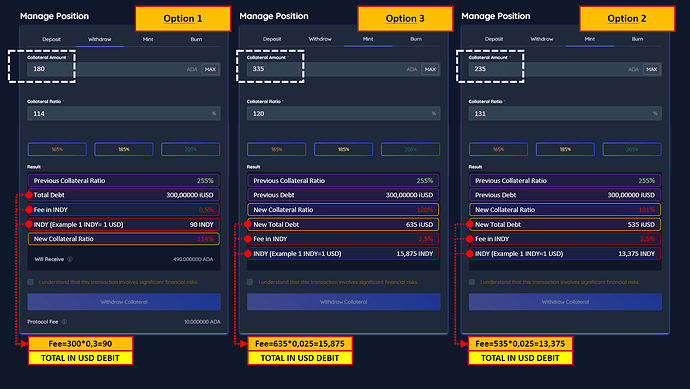

Option 1

Option 2

Option 3

(If you have a better option than the ones I put, add it.)

These fees would be collected at ADA, prior to the application for synthetics.

I will put as last 2 examples based on option 3:

1 iUSD= 1USD

1 ADA= 1USD

Proposal for CDP Deposit and Withdrawal Fees

The fees would be collected in ADA, prior to the application for synthetics.

Here are 2 examples based on option 3:

1 iUSD = 1USD

1 ADA = 1USD

1- Depositing 10 ADA to request a collateral of 190% in iUSD would be 5.26 iUSD. The contract tells me to pay a fee of 0.25% with respect to the 5.26 iUSD. I pay 0.0131 ADA (that fee is used to pay those who have the synthetics in the stability pool).

2-(From the previous example) I already have my collateral of 190%, but I want to ask for more and I leave it at 130%. The previous debt is calculated and added with the new debt and gives us 7,692 iUSD. This would charge us a new fee that would exclude the one we have already made. The fee to be paid is 2.5% 0.1923 ADA, and if we add the previously incurred debt we will have paid a total of 0.2054 ADA.

If we do not take into account the debt already deposited, we would be cheating and paying less in fees, therefore, it would be more economical to make a single debt, whether it is big or small, it will depend on the investor. The burning of synthetics would not have any fees. If you have a better proposal, please comment. Again, this is a proposal and can be modified or rejected.

Note: Both deposit and withdrawal fees can be charged in Indigo or ADA tokens. If Indigo is used, the token will have a better value.

Note: Burning synthetic tokens and adding more collateral in ADA have no additional fees in this proposal, the fees are only for minting synthetic tokens or withdrawing collateral to increase leverage risk.

Conclusion

I make a completely different proposal from my previous proposal to limit the creation of synthetic tokens to 200% or 250% for responsible leverage, which was criticized. Instead of limiting the creation of these CDPs, I propose the opposite: reduce or increase fees for minting or withdrawing collateral as the collateral itself moves away from or closer to 110%. If a user requests synthetic tokens with collateral of 200% to 250%, they would pay a minimum or zero fee. If the collateral is approaching 110%, the loan would have a much higher fee. The fees would be directed to the stability pool for the requested synthetic tokens, and there would be no fees at any time for the burning of synthetic tokens, which would be an added incentive for those who delegate their synthetic tokens to the stability pool. This approach balances risk and reward for those interested in responsible leverage and improves the confidence of those seeking to invest in the Indigo protocol.