Proposal for Parameters change

Introduction

Following the launch of Indigo Protocol V2, new parameters were introduced to enhance peg management. The interest rate for the iUSD market was initially introduced at approximately 21%. This introductory rate was intended to allow CDP users to adjust to the new interest environment gradually. However, this rate remains significantly lower than comparable markets and has not sufficiently improved the peg.

This proposal aims to align Indigo’s rates with the average borrowing rates of other stablecoins in the ecosystem. In the calculation, the liquid staking nature of CDPs, which allows users to participate in staking, ISPOs, and governance voting is also considered. The current median collateral ratio aka “CR” in the system is higher than the initial 185% Redemption Margin Ratio (RMR), warranting an increase in the RMR to better reflect the mode of the Protocol’s CDP collateral ratio curve.

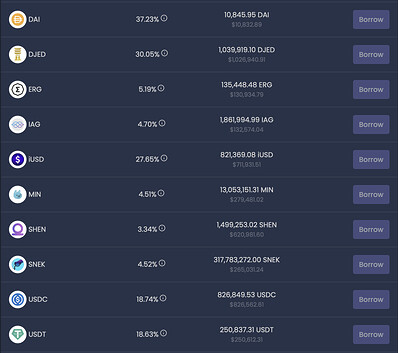

Let’s reference the supply levels of the top three stablecoins in the largest lending and borrowing markets:

DJED: 30.05%

USDT: 18.74%

USDC: 18.63%

Proposal Details

To stabilize the iUSD peg and ensure the long-term health of the Indigo Protocol, the following changes are proposed:

-

Interest: Increase the annual interest rate for the iUSD market from 21% to 32%.

-

RMR: Raise the Redemption Margin Ratio (RMR) for the iUSD market from 185% to 300%

.

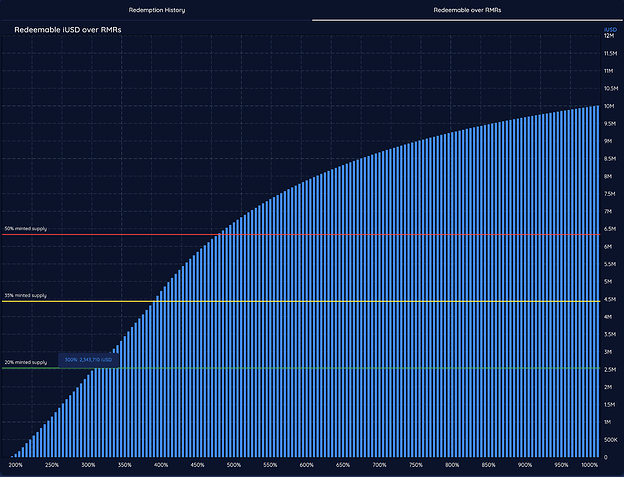

With iUSD set at the RMR threshold of 250%, we can see that roughly 589k iUSD would be in the redeemable zone. If the entire redeemable amount is redeemed, less than one-quarter of the total supply of iUSD would be eligible for redemption. It is estimated, based on the iUSD liquidity on Minswap, Wing Riders and SundaeSwap, that roughly 180,000 iUSD net purchase is needed for supply to be balanced excluding any marginal sellers.

As of June 21th, we can see the number of total iUSD that is eligible for redemption at each listed RMR threshold ranging from 250 to 400%:

- RMR= 400; redeemable= 4,726,918 iUSD

- RMR= 350; redeemable= 3,442,083 iUSD

- RMR= 300; redeemable= 2,343,710 iUSD

- RMR= 250; redeemable= 1,153,519 iUSD

Rationale

When V2 was adopted by the DAO, the members voted to ease into the V2 parameter and feature updates. The success since V2 of iBTC and iETH has demonstrated the potential benefits of appropriate interest and redemption levels.

It is now time to take action to stabilize the iUSD market. By increasing the RMR to 300% and the interest rate to 32%, the supply of iUSD will be drawn off DEXs and returned to the protocol. This reduction in supply will help push the value of iUSD back to its target peg.This is a necessary and aggressive leap in order to regain its peg and establish a solid and stable foundation for Indigo’s future growth. Indigo Protocol V2 delivered the needed features to manage iAsset pegs and was the priority of its design specifications, as stable iAssets are needed for the Indigo ecosystem to build a strong foundation. Now is the time to use these features to achieve this goal and give the Cardano DeFi ecosystem a more reliably pegged stablecoin. By adopting these changes, the Indigo DAO will be better positioned to manage its iAsset pegs and move forward with confidence, delivering on everyone’s goal to build a robust and sustainable ecosystem for all stakeholders. With a reliable and sturdy peg within a reasonable range, the entire ecosystem can benefit and grow, not just Indigo Protocol.

It should be expected that these aggressive parameters will be revisited once the peg for iUSD is sustained for a considerable duration of time such that they can live up to its potential for additional uses in the Cardano DeFi ecosystem.

Update 2 July 2024

The proposal has been updated with changes to the following:

- Proposed Interest to stay at 32%

- Proposed RMR 250% instead of 300%