That’s a good idea, but there might be a problem with doing so many transactions and the unnecessary fees associated with it. We don’t know yet how we will “claim” the airdrop, but sending like 4 transactions would cause for an unnecessary amount of claiming.

There are many different suggestions regarding airdrop. I agree more with some and less with some. Before you turn away the wider interest in this whole ecosystem, I suggest you take a look at the Cosmos ecosystem for a comparison. I am in it with most of my money, they have a lot of airdrops, but more and more people come to it and invest new money and the airdrops also stay in it for the most part. I suggest that you consider a similar strategy in this, without putting pressure on the community, which has different levels of knowledge and understanding of staking, LP … It should be done for the average user and not Walles, who can in continue to buy a coin while we will remain stake or LP and we will have cash tied to e.g. in 6 months, the big players will be selling coin … Everything has been seen many times. The prize should also, in my opinion, follow the logic of Fairdrop and not the proportional airdrop system, because this is again done for Walles. There should be a reward for these in% APY.

you are correct on your assessment, IMO, myself and a couple of people that I know received LQ and believe me we are sticking with them and not selling. itching to provide liquidity with the protocol, very small amount right now with SS.

Among the most successful launches in the Cardano ecosystem (besides MuesliSwap) has been Meld and Liqwid Finance.

Both of these protocols have a bright future and anyone fortunate to be holding these tokens are in position to earn a profit.

I believe Meld has an excellent strategy because they have multiple incentives to keep their tokens. As an example, their staking APY % is very competitive with any other staking rewards (including stablecoins).

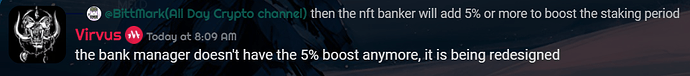

Second, their upcoming bank manager NFT’s will have the ability to increase staking APY% if you participate in the staking pools of their partners (i.e. Maladex and IAMX).

Futhermore, Liqwid Finance has created partnerships with SundaeSwap and many have used their LQ rewards to provide liquidity and yield farm. Thus, many are still holding a large % of their LQ tokens from the airdrop.

In short, “composability” helps new platforms start strong and with Dewayne Cameron (Liqwid) and Hai Nguyen (Meld) behind the helm I believe Indigo can be the leading algorithmic, autonomous synthetic protocol of the future.

A correction on this part about MELD, the bank manager NFT no longer gives 5% yield and is being reworked since MELD wanted to let the community do twitter based events to level up their individual bank manager NFTs. However, there were some mishaps which did not allow this to occur. Regardless, if it were to be utilised I think it would have been a great idea proposed by them. This can checked in the MELD discord by asking their team members.

Yes, could be fair and safe to spread the distribution on 4 or 5 months … ![]()

Incorporating a vesting schedule into the release mechanism will significantly increase gas- I appreciate it is low but from a cost perspective it will add a lot. What may be a better approach is a staking reward mechanism

Maybe a lock based on percentage. Could get costly to pay all those transactions fees for multiple drops.

Doesn’t work. you are just postponing the selling time.

Just adding a bit into your comment:

We cannot forget there are members in our community thar live in non-developed countries. I remember of a guy who received the LQ airdrop and sold most of it for 30 ADA each. That value was the same as his annual salary. Even though I believe that Indigo will do an incredible job in the long term, I cannot judge someone who receieved an airdrop (assuming there will be one) and sell the token once this is life changing for them.

So, spliting the airdop into multiple periods would maybe soften the impact of these peoples in particular selling there hold of tokens and allow the others to stake or add some liquidity to it ?

It will be extra work for the dev team and honesty I think it’s better to let them work on the actual product other than focus on how to prevent token dumping from airdrops receivers.

It is a good way to hold long-term, but considering that there is also a short-term investment in investment, it is a matter to consider.

It will just delay the massive dump I think. People will just wait until they got all the token and dump it in an order. If they want to dump the token right after receiving it, there’s no way to prevent it.

I do agree with this. Minswap one is really confusing and it seems to create a lot of more work for the team. I don’t think it’s necessary to put that much effort on this.

Do you mean they can accumulate the token and dump all of it at once? Not a good idea tbh. Instead of preventing people from accessing the token to avoid possible dump, I think it’s better to propose some benefits for token holders. It’s more positive I think.

Same thought. It doesn’t work from my point of view. It’s just a delay.

Don’t know if it would be technically possible but …

Like Vyfi did, create a stackable NFT. But make a “smarter one” that would be paired with the amount of tokens owned by an address, and get a better APY if you hold more token in your wallet and Stake that INDY NFT you get ??

This learn to earn model is one of the best way to have more real community members other than airdrop hunters. I think this can be one of the way to distribute the token, but not the only method.

I know what you mean and I’m guilty of this on other protocols, but being a Cardano project I’m going to use the token as is intended to.