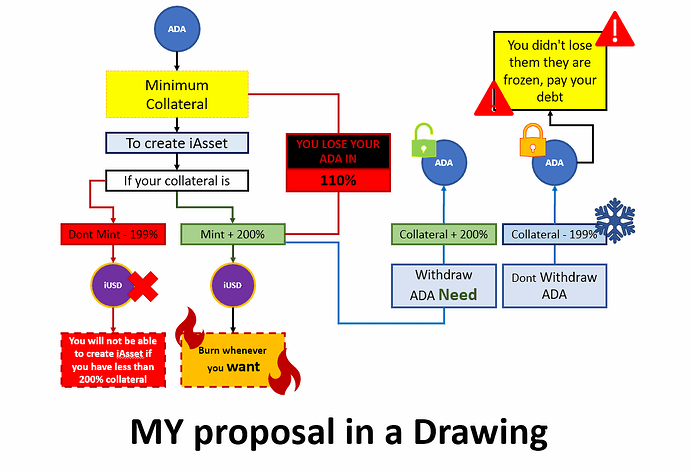

I think that many do not understand my proposal, so here I leave a more graphic scheme so that you understand it better, this is for the health of the protocol. If you want ultra leverage you can use another DEFI protocol, but Indigo is not designed for that.

1 Like