Again, I appreciate and understand your points. The one thing I wanted to comment on however is protocols like venus, sienna etc are money markets. They are simply borrow/lend protocol. With a variety of highly volatile assets, naturally they need to be over collateralized significantly.

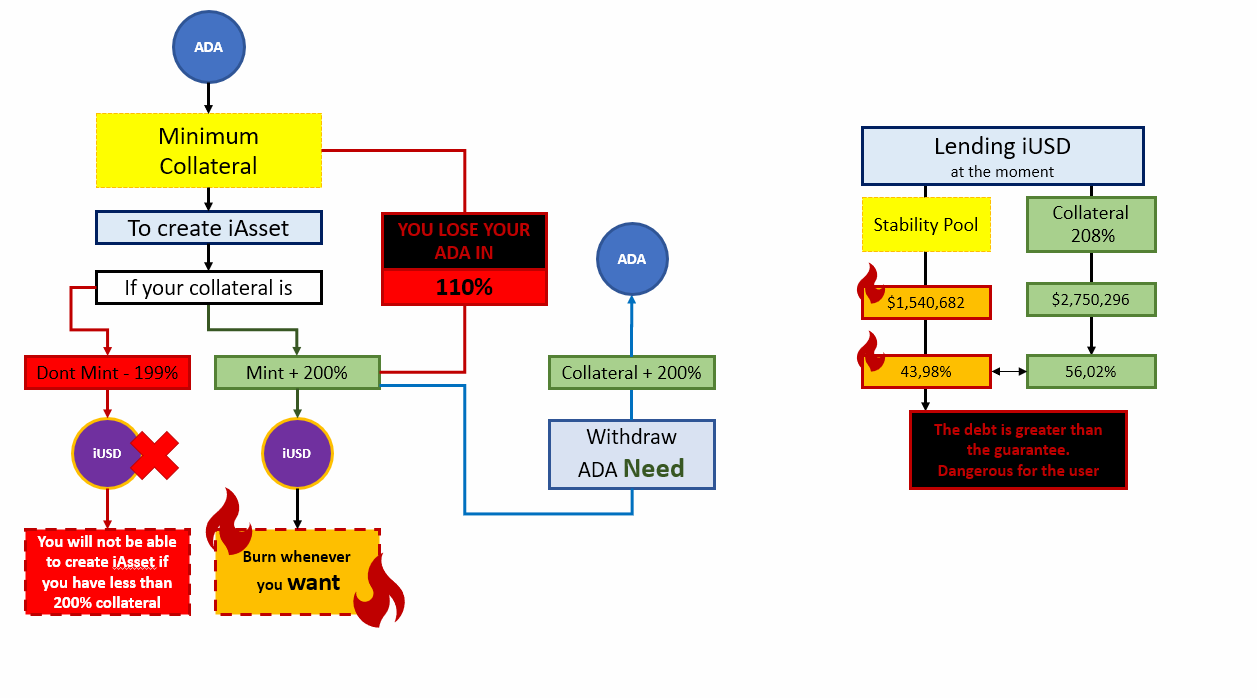

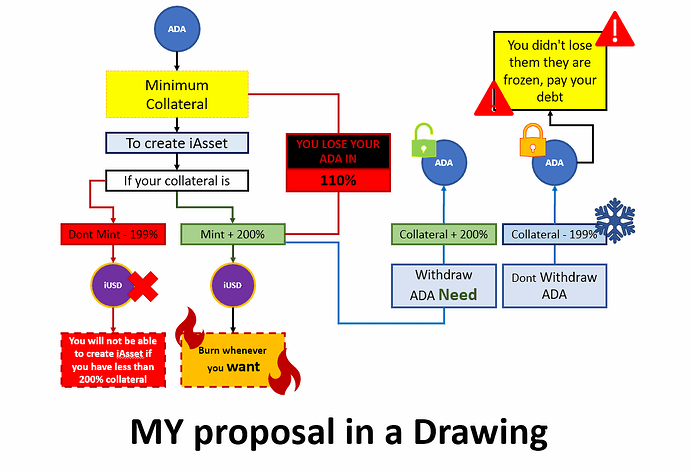

Creating a collateralized debt position (CDP) and minting a synthetic is a completely different process with different attack vectors and advantages. 110% is not “ultra leverage” it’s not even leverage in fact unless you’re looping. You always need to put up MORE collateral than you’re taking out in iAssets if creating the CDP.

The iassets could then go on to be used in money markets or within other borrow /lend protocol if governance took things that way. But there is 100% a very clear difference between a straight borrow/lend money market and minting synths with a CDP. Something like HAY (which admittedly I don’t know a ton about) appears to be more similar to this, where you’re minting an asset based on a CDP. Venus, I can put up a little ADA, a little USDC, a little XRP and borrow a little Bitcoin etc. Those are all real, 100% backed assets. CDP’s are creating synths and it does create an imbalance.

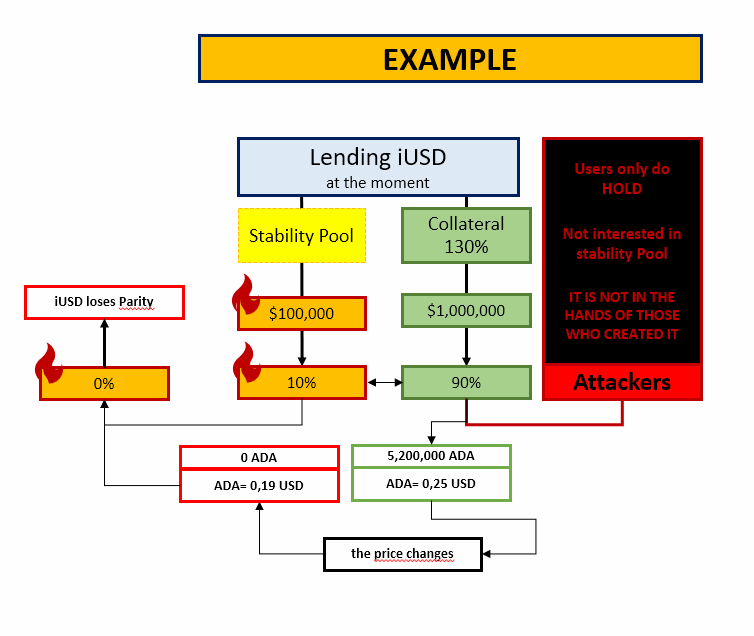

While YOU may not be using your iUSD in the stability pool, I know plenty who are, and just the fact that theres >1 Million iUSD in the stability pool speaks to the fact that plenty are going that route to boost their INDY rewards which have thus far paid out handsomely to protocol users and particularly stability pool depositors.

I believe equating a CDP minting synthetic assets with money markets is a mistake and not how we should be looking at Indigo. The systems are very different and the creation of bad debt in the system would come from very different sorts of attacks than for example what’s been done on venus (an example with venus was a depositor depositing LUNA / UST during the depeg event which was then used to borrow USDC, BTC, ETH etc at max LTV. In this example the protocol was left with bad debt)

In Indigo’s case, the issue is the opposite if anything. There is upwards pressure on peg and on DEX right now, buying iASSETS is closing in on more expensive than a 110% CDP. Pushing that to 200% is just far too extreme for this type of protocol. We need CDP’s in order for liquidity to exist. If people are seeing better returns just market making iAssets on dex it doesn’t do nearly as much for stability as creating new CDP’s (correct me if I’m wrong)

In venus, I can deposit 1000 ADA, borrow 750 ADA for example, deposit that borrowed 750 ADA as collateral, borrow 500 more ADA etc etc etc. THAT is leveraging a position (you can end with >2x looping in venus).

In Indigo, I deposit 1000 ADA, borrow iUSD or iBTC which needs to be traded into ADA in order to “loop” a position. This is healthy for the system and also thickens liquidity on the DEX’s as more and more iUSD/iBTC needs to be traded (encouraging LP’s to earn the trading fees, which encourages more CDP creation etc etc) in order to “loop” and actually leverage the position.

Otherwise, we’re minting synths and a more comparable protocol would be synthetix. They similarly create synthetic assets backed by SNX as collateral. SNX is extremely volatile, low liquidity, far lower market cap, and requires 400% collateralization. However, on SNX, the min collateralization ratio for Ethereum is 150%. A blue chip asset with much deeper liquidity, a larger market cap, and FAR more capital required to induce artificial volatility into, much like ADA itself. SNX market cap is so tiny, a single whale holder could manipulate the SNX price and that’s why the collateralization ratio is so high. When using a blue chip like Ethereum however? only 150% required and No liquidation until 130% per their whitepaper/documentation..

I would argue ADA is extremely similar to ETH in this scenario where a protocol is using CDPs to mint Synthetic assets. This is much more comparable than a direct money market like venus. 150% is reasonable. I still don’t understand where the 200% number came from I guess is my major remaining question.

What makes 200% a suitable number to you and how does that incentivize creation of CDP’s for anyone other than a “green minter” currently (195%+ CR)? The bulk of the positions on Indigo and the bulk of the strategies I’m aware of use a CR lower than 195% and would likely not use the protocol if 200% was a requirement. Again, If I’m missing something feel free to point it out. I just wanted to draw a more accurate comparison (in my opinion) to Indigo by using Synthetix rather than a straight money market which naturally needs to be overcollateralized…if you deposit, you are lending your assets out. Of course you’d want the borrower to be overcollateralized in that situation as it otherwise introduces extremely easy ways to create bad debt in the system.

If I could deposit 1000$ worth of ADA and borrow 1000$ USDC from Venus it would be too easy to dump ADA on venus before a correction or mid correction and just run with the USDC. In Indigo’s case, where are you going to run to? The only place to currently benefit from iUSD in any way is to use it within the indigo ecosystem, benefitting the protocol directly in some way from the creation of EVERY CDP (whether LPing, depositing in stability pool, or simply creating trade volume, it all benefits INDY holders+stakers directly…all revenue/fees come back to the protocol etc. I just see them as entirely different scenarios.

With a money market, you can “take the money and run” so to speak…with Synthetics, where are you running to? Go ahead and try, the system even at 110% is overcollateralized with ADA. 100% backed assets can be used and moved anywhere, iSYNTHS are usable only within the Indigo ecosystem. This is the key difference I’m drawing attention to.

I voted. Thanks for the work on the proposal and the discourse. I hope others chime into the conversation to navigate through this and find a proper MCR.

Edit: By the way juancardano, I just wanted to say you’ve been extremely polite and respectful during this little “debate”. I see and appreciate that. Especially with English not your native language, I wanted to emphasize that when I use caps it isn’t to represent emotion or anger, only emphasis. I really appreciate the time you took to explain your points and you helped me quite a bit in understanding the protocol. I hope we continue to have beneficial discussions moving forward. Thanks mate.