Would be great to see what my CDP would be valued at if the Iasset that im borrowing returns to its true peg.

IE. IUSD trading at .80 USD inflated my collateral ratio much higher than if Iusd were to peg at $1. So its helpful to see what my CDP collateral ratio would be if ADA remained the same price but IUSD were at its intended peg.

This would help incase there were a sudden peg. As a CDP owner, i want to be prepared and not get caught minting without having a view at the discrepancy with the iasset peg.

I am not sure I understood your point. The current price you see in a dex is not the oracle price within indigo webapp. When you open a CDP and mint an iAsset (let’s use iUSD as an example), your debt is the amount of iUSD you minted. Consider this scenario:

1- You deposited 10k ADA and minted 1250 iUSD (when the price of 1 ADA = 0.25 cents and 1 iUSD = 1 USD). Your a collateral ratio was 200% at the time you minted

2- Your debt is, therefore, 1250 iUSD

3- Time passes and now many people are bullish with ADA price and decided to sell their iUSD for ADA. ADA price goes from 0.25 to 0.50, and your collateral ratio improves from 200% to 400%

4- iUSD is traded now 0.75 cents at minswap

5- You can now buy 1250 iUSD for the equivalent of 937.50 USD (using 1875 ADA, instead of 2500 ADA).

6- You burn your 1250 iUSD debt for a lower price and you can unlock your collateral (minus the 2% fee that is currently being charged and that might be removed when protocol v2 arrives)

thank you for your read on this borges, i do understand the nature of borrowing, minting, burning and fees.

the idea of seeing the true peg value is useful when understanding how far off the iasset actually is to its true peg. right now iusd is trading at .77 to the dollar, worth 1.5 ADA. but if it were trading to is true peg ($1) it would be worth closer to 2 ADA which would be a 33% swing on a what is supposed to be a dollar peg. and this is without ada moving.

Given the liquidity and nature of the fluctuating IUSD, IUSD could trade up faster than a ieth or an ibtc peg. this would equate to a lot of cdps getting liquidated. of course everyone needs to understand the risk and the smart contract they signed for but to be able to see the potential for IUSD to repeg and crush a cdp is sometimes misunderstood or doesnt cross the mind for some of these investors.

so to see a flag or mark where the value of an iasset is supposed to be (its true peg) would help to set expectations and mitigate risk. it answers the question: what would happen to my cdp if iusd were to repeg and ada stays where it is now.

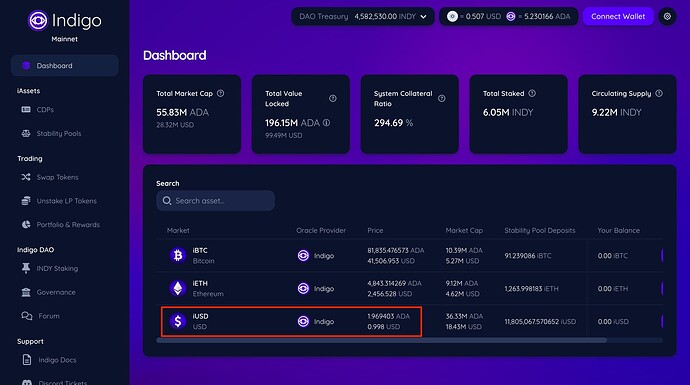

Just to be clear, if you have a CDP open for iUSD the only price it matters for the health of your CDP is the Indigo oracle price (that you can easily check in the main page of the webapp, as in the image below), and not the price at dex.

Let’s say ADA hasn’t changed a single cent in coinbase/kraken/binance/etc for a whole day, but the price at minswap has skyrocketed that 1 iUSD = 1 ADA (meaning 1 ADA = 1 dollar). This price change will not affect the health of your iUSD CDP, because the oracle price is not based on any cardano dex. So, what’s going to happen to your CDP when iUSD regains its peg? Nothing.

If a whale decide right now to buy iUSD to restore the peg suddenly bringing 1 iUSD = 1 USD, your collateral ratio stays literally the same. Because the oracle price used at indigo is not based on ADA/iUSD, it is based on ADA/USDC, ADA/USDT and ADA/TUSD (Advancing Stablecoins Part 1: iUSD’s Triple-Peg Architecture Bolsters DeFi Resilience on Cardano | by Indigo | Medium).

So, if you decide to open a CDP for iUSD (or iBTC or iETH) the only thing you should pay attention to not be liquidated, is the ADA price action (in the the whole crypto market), and not the iUSD price.

thanks again, that is not the case that if you mint a iasset that you should only care about the oracle price and not the market rate. lots of investors decide to sell the iasset and long ada to capitalize on ada price increasing and potentially the iasset decreasing or depegging. so the going market rate is most important. the discrepancy of the iasset oracle price and the true market price is always good for investors to see and understand and have in front of them in one place to make better decisions and be well informed. thank you again for clarifying how the protocol works, the intent of the true peg discussion is to add useful tooling to the protocol so we have more information because there are lots of different strategies that include logging and shorting iassets after minting