TL;DR

The Indigo DAO has recently passed Proposal #23, titled ‘Liquidity Pool Reward Change’. That successful Proposal provided that some of the reward tokens to be emitted by the Protocol be allocated to holders of LP tokens on DEXs (and not to DEX-created LP tokens staked to the Protocol) as a way to better support the building of liquidity on the DEXs.

However, Proposal #23 did not address any changes to token reward emissions - either as to the rate of emissions over the coming years or the allocation of emitted reward tokens.

In this proposal, we suggest that the allocation of reward tokens be adjusted to better allocate rewards between Stability Pool depositors and liquidity providers since both play a crucial role in ensuring the Protocol’s well-being and rewards currently over-favor Stability Pools; and we suggest that the timeline for emissions be extended by three years.

Specifically, this Proposal makes four suggestions:

-

Maintain the current per epoch INDY token rewards emission rate of 35,961 INDY tokens per epoch and reverse the current plan, coded into the Protocol smart contracts, to increase reward token emissions to 46,748 INDY tokens per epoch starting in December 2023;

-

Extend the current emissions schedule approximately 3 additional years, so that instead of exhausting all rewards tokens by December 2027, we extend rewards to October 2030;

-

Give the DAO Treasury the surplus reward tokens that will be emitted starting in December 2023 until the Protocol smart contracts and the governance smart contracts can be upgraded in the V2 Protocol upgrade in 2024 (that is, the 10,787 per epoch INDY token difference between current reward token emissions and the December reward token emissions should be given to the DAO Treasury until the contracts can be upgraded to again emit only 35,961 INDY per month); and

-

Adjust the allocation of token rewards between liquidity providers to DEXes and Stability Pool depositors in the Protocol based on the Market Cap TVL of each iAsset.

Reminder: The DAO has the control to adjust rewards at any time. We expect further adjustments to be warranted in the future as circumstances change, and hope that the DAO community and its working groups plan to monitor and further right-size reward amounts and emission rates whenever changed market dynamics warrant it. The DAO community is encouraged to stay focused on maintaining an optimal rewards structure for the protocol.

Background Information

This Proposal suggests extending the current rewards emissions to give the DAO additional runway to support the Protocol’s adoption and use case. The proposed rewards extension will give another 3 years of runway (taking emissions into late-2030) as a way to help ensure the Protocol is self-sustaining when all rewards have been emitted. Key to the ability to extend the emission will be slowing the rate of token emissions.

This Proposal also suggests changes to the way reward tokens are allocated each epoch. Currently, rewards for Stability Pools take the vast majority of per epoch rewards (about 80%), but the Stability Pools are also very over-subscribed (that is, a lot of users are minting iAssets and depositing them into the Stability Pool for the iAsset rather than using the iAsset for other beneficial purposes off of the Protocol out in the Cardano DeFi ecosystem). The rewards being allocated to Stability Pools today are based on the Indigo whitepaper, which in turn is based on some reasonable assumptions from a year ago of what rewards would be required to ensure that Stability Pools were sufficiently subscribed. The track record for the last year shows to us that fewer rewards are needed to ensure that Stability Pools are sufficiently subscribed. We believe it would make the Protocol more stable and grow more steadily if we change the rewards allocations and provide a larger portion of rewards each epoch to liquidity providers as this will better encourage iAsset holders to use iAssets in DEXs and otherwise out in the Cardano DeFi ecosystem.

To achieve this, we suggest implementing a new process where the allocation of rewards between Stability Pools and liquidity providers is based on a formula that balances the ratio of the Market Cap of iAssets in Stability Pools versus the total Market Cap of all iAssets. This is a calculation that will be done for each iAsset. This will not increase the total rewards emitted, but will just allocate a greater share to liquidity providers.

This formula will not be a smart contract-driven calculation that automatically updates. That is possible in the future, but for now this will be a static change that will need to be updated periodically through later votes by the DAO We suggest that the PWG take ownership of reviewing the formula output on a regular basis and initiating a Temp Check whenever they feel that the rewards allocations should be updated in light of changes to the Market Cap ratios or introduction of new iAssets.

- Proposal to Maintain Current Emissions, Extend the Overall Emissions Timeline, and Give Surplus to the DAO Treasury:

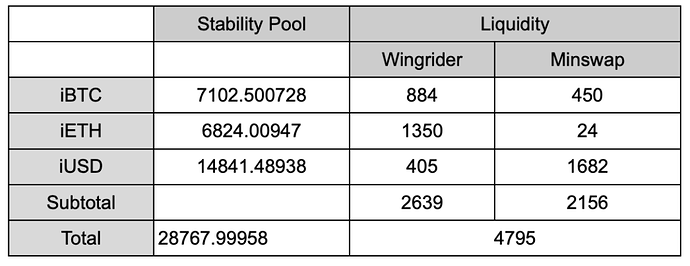

Below is a summary of where we stand today as to token reward emissions for each of the three actions being rewarded:

- Governance staking is allocated 2,398 per epoch

- Stability Pool is allocated 28,768 INDY per epoch

- Liquidity Staking receives 4,795 INDY per epoch

Total emission for each epoch = 35,961 INDY

The smart contracts launched with the Protocol in November 2022 are coded for the emission allocations to increase in December 2023 (e.g., one year after launch of the Protocol) as follows:

- Governance rewards: 3,596 (Effective 6th Dec 2023)

- Stability Pool rewards: 33,562 (Effective 1st Dec 2023)

- Liquidity rewards: 9,590 (Effective 21st Dec 2023)

Total emissions for each epoch = 46,748 INDY (an increase of 10,787 per epoch)

Our first proposal is to cancel the scheduled increase in total reward token emissions which will occur in December. But while we say ‘cancel’ we cannot actually change the smart contract until the V2 upgrade in 2024; so it will fall to Labs (as the entity hired by the DAO to distribute rewards) to manually continue with rewards distribution at the prior emission level and to transfer the increased amount of 10,787 tokens per epoch to the DAO Treasury (as mentioned below).

Our second proposal is to extend the emissions schedule - something that will be made possible by reversing the token emission increase as part of the V2 Protocol upgrade. The present emission schedule is set to continue until December 2027. We propose extending the timeline for token rewards emissions from 2027 to late 2030, an increase of a total of 34 months. We believe that this extension will give the DAO greater flexibility to adjust and fine-tuning of the economics for the Stability Pools and liquidity providers across multiple future market cycles, and that it will help ensure that the rewards tokens available for emissions are not over-allocated to the current low-transaction volume and low TVL environment that we are in during the on-going crypto winter.

The third proposal involves what to do with the additional 10,787 tokens scheduled to be emitted between December and whenever Protocol V2 is online in 2024. The smart contracts which will increase token emissions starting in December cannot be changed until the full Protocol V2 upgrade happens in early 2024, as mentioned before. This Proposal suggests that those INDY tokens be directed to the DAO Treasury. If the Protocol V2 upgrade (pending DAO approval) takes place on 30 March 2024, for example that will mean that approximately 238,510 INDY will have been transferred to the DAO Treasury under this Proposal as of that date. The net impact will be increasing the DAO Treasury by roughly 5% of its current total. Of course, any delay in the Protocol V2 update of the emission smart contracts will commensurately increase the amount transferred to the DAO.

The following schedule shows how the emission would look if extended:

- Rewards Allocation Revisions:

We believe that it is time to introduce a reward token allocation that’s more market-responsive. It has been nearly a year since the Protocol was released, and we believe that the data to date supports that the current model disincentivizes user of iAssets outside of the Indigo Protocol because the Protocol currently over-incentivises keeping iAssets within the applicable Stability Pools within the Protocol.

We propose giving a greater share of per epoch reward tokens to liquidity providers on DEXs. Incentivizing deeper liquidity should result in broader iAsset adoption and use in the Cardano DeFi ecosystem without impacting the solvency of the Protocol given that the Stability Pools are currently over-subscribed. We’re proposing a fresh allocation balance between Stability Pools and liquidity on DEXs, designed to bolster liquidity incentives. It remains critical as always to safeguard the Protocol’s solvency via Stability Pools; but we believe we can still do this while supporting greater liquidity for iAssets in the Cardano DeFi ecosystem…

For community reference, below is a chart showing how the Protocol currently allocates and distributes token rewards each epoch (one of the tasks that Labs has been hired to manage for the DAO):

Currently this is the rewards token allocation between Stability Pools and liquidity on DEXs for Epoch 439 on 28 September:

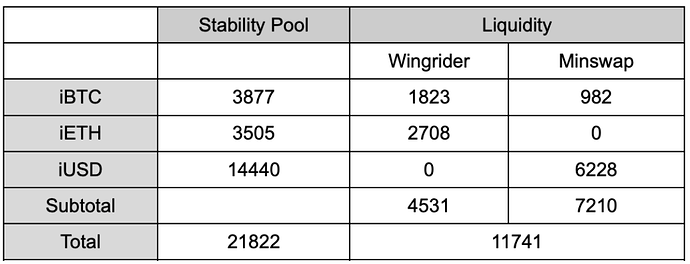

If this Proposal is adopted, the chart below shows how rewards would be different based on the Market Cap of each iAsset on 26 September:

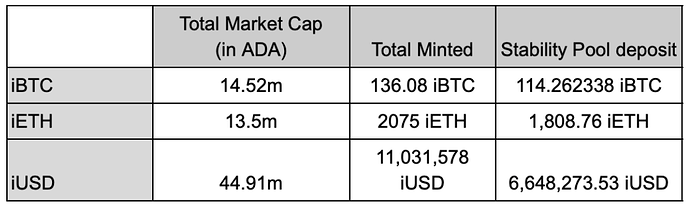

Now to get into the weeds: In the next section, we walk through the new formulas we are suggesting and how they interact. We use for this example Protocol data as of 26 Sep 2023, as follows:

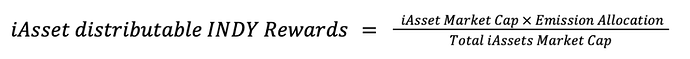

Stability Pools rewards and liquidity provider rewards will be allocated to each iAsset in proportion to its market capitalization relative to all iAssets combined:

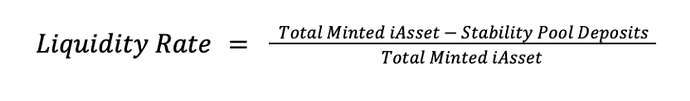

To distribute the INDY token rewards between each iAsset Stability Pool and liquidity providers, we’re leveraging a combination of minimum Stability Pool allocation and utilization to determine the Stability Pool’s share. Utilization can be determined using Liquidity Rate as follows:

To determine the Stability Pool’s share of rewards, we use a base allocation (50%) and adjust it with the Liquidity Rate, multiplied by another 50%.

If the Liquidity Rate for any iAssets drops below 5%, that iAsset may be seen as non-functional, and both its Stability Pool and liquidity rewards may be changed to zero by DAO decision.

This method offers a baseline allocation for the Stability Pool, allowing adjustments tailored to each iAsset considering market conditions and MCR variations.

As shown in the earlier chart, these formulas result in a material increase in allocation to liquidity providers outside of the Protocol.

As the Protocol grows - both in terms of the number of iAssets, the overall Market Cap of all iAssets, and distribution of iAssets in the Cardano DeFi ecosystem - the DAO can recalculate and adjust rewards at its discretion. The overall goal of all incentives is to maintain equilibrium until the iAssets achieve sufficient liquidity and self-sustainability. We believe that this is a necessary step on the path to get to that point as soon as possible.

Conclusion

We hope this proposal triggers an active and engaged conversation with the community and DAO Members from here. We believe that this proposal will help optimize reward distributions and give more control to the DAO on deciding how/where rewards can be modified in the future. We ask for everyone’s support and look forward to answering questions.

TEMP CHECK UPDATES PRIOR POLLING - 09 Oct 2023

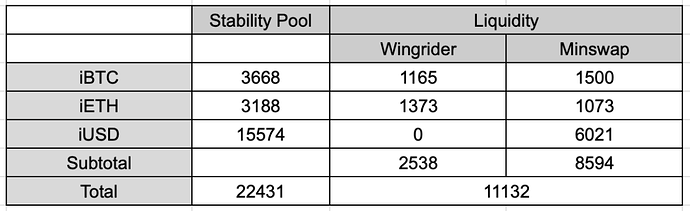

The final snapshot on 8th October based on the above framework shall yield the following allocation instead.

This is the result of liquidity movement between the DEXes.

- Increased of 900k in minted iUSD result in higher allocation going to iUSD

- Shift of liquidity from Wingrider to Minswap

iBTC - 600k ADA TVL

iETH - 1.5m ADA TVL

iUSD - 2m ADA TVL