IMPORTANT!!! If you think that my proposal would help and solve the current problem, please vote and like.

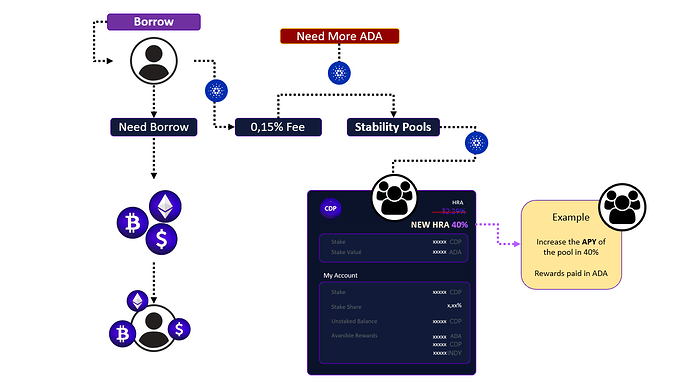

I propose a fixed fee of 0.15% on the amount that is requested as a loan or is returned. For example, if I request a loan in iUSD (or any other synthetic), I pay a 0.15% in ADA. On the other hand, if I return iUSD, I pay the 0.15% fee in iUSD. This fee would only affect new positions created when requesting a loan and the amount of synthetics to be requested or returned. The fees would be sent to the Stability Pools to increase the interest of the synthetics, reduce the impact price of the DEX and increase the liquidity of the synthetics. In this way, this proposal seeks to maintain the stability of the system in the DEX and provide greater profit and profitability for both the Pools and the INDY token.

This fee would also significantly reduce over-leverage or the limit when requesting a loan to only send it to the Stability Pool, earn in Indy and then sell it, providing an opportunity for those who buy synthetics to earn Indy.

This proposal is better than increasing the MCR or RMR.

When paying in synthetics, the holders of these in the Stability Pool would earn profits in ADA for liquidations and INDY tokens. However, with this proposal, profits would increase each time a loan is requested or returned, as more ADA would be obtained when requesting more synthetics or when returning them. If the synthetics are returned, they would have to be paid with these, becoming an additional reward in the Stability Pool. In case of not having funds in synthetics, debtors would have to search for and acquire more synthetics from the DEX to pay off their debt, which would contribute to the stabilization of the price of the synthetics in the DEX.

In summary:

1-The APY of the Stability Pools would increase.

2-The Stability Pools would pay in ADA for liquidation, for loan request, in Indy and in the synthetic corresponding to the Stability Pool.

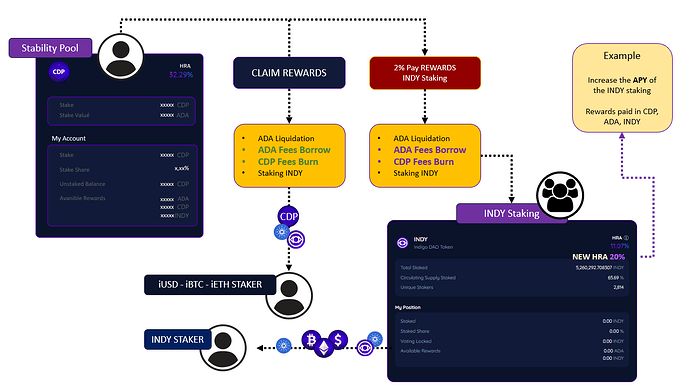

3-The Indy token would take the same 2% of all rewards from the Stability Pool, including the synthetics, which would increase its interest and its APY.

4-There would be more interest in having iUSD, iBTC, iETH, which would attract more liquidity and more token purchases, stabilizing the pool.

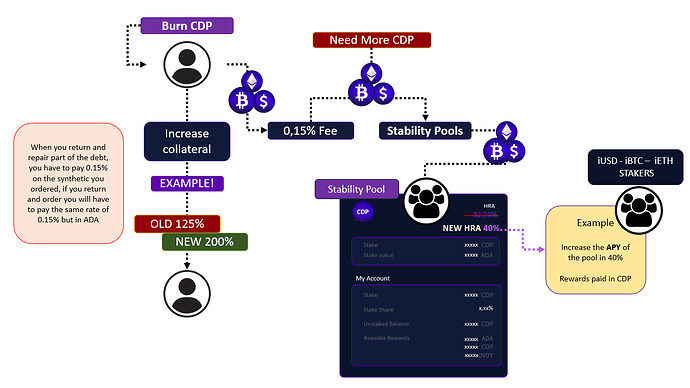

Important note 1: when paying the fees in synthetics when returning the synthetics, the assets are not being burned, these fees are transferred to the stability pool

Important note 2: The 0.15% fee is, to consider, the community proposes or we put a low but functional percentage. Whether it’s 0.1% or 1%, I put a percentage that would be fair to everyone and that would not affect those who later want to return their synthetics, the price of 0.15% I have considered because it is half of what a SWAP is worth.

Interest is generated in the CDP, leading to increased supply and demand. Assets would appreciate faster as it will always be necessary to have more CDP to pay off the entire debt. In the event of default, ADA would go into liquidation. This would alleviate the impact price on the DEX.

New info:

The problem does not lie in the stable currency.

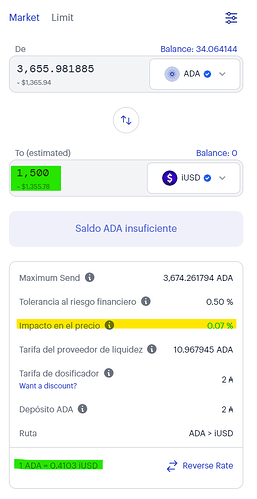

1-The problem lies in the DEX, as the impact price is very high due to low liquidity in the POOLs.

2-The iUSD requested by the debtors is used in the Stability Pool to earn INDY. My proposal seeks to put a limit to this.

3-The iUSD needs real benefits, in addition to liquidations and INDY tokens.

My proposal would alleviate the price of iUSD, with the following aspects:

1-Those who are extremely leveraged and have already requested their iUSD, or if they return the funds after voting this proposal, will have to pay in iUSD. This would reward the new and old holders of the iUSD asset in the Stability Pool.

2-When withdrawing the funds (artificial from the leveraged) to earn INDY, the rewards from the Stability Pool would also increase, increasing the interest of the synthetics.

3-The value of INDY would rise due to interest in the new rewards, which would also increase the value of staking in the Stability Pool. (This will also increase people’s interest further

Examples:

The system for requesting is the same as the current one, so when you request a loan, it’s exactly the same as when you add collateral and receive synthetics like iUSD. The difference is that a percentage of what you request in iUSD is calculated. In your wallet, you must have 0.15% in ADA of the funds to send them to the Stability Pool.

For example,

if 1 ADA is worth $0.40

if 1 iUSD is worth $1

If you request 1000 iUSD, the protocol will ask you to send the 0.15% fee in ADA to the Stability Pool. In your wallet, you must have an amount of 3.75 ADA to pay the transaction fee. Those who have iUSD in the Stability Pool will share the 3.75 ADA.

In case of returning or burning the iUSD, you will be obliged to have 0.15% of what you burn in iUSD. This will force you to buy more iUSD.

If we consider the same example but with a daily volume of 1,000,000 iUSD returned, if the entire community returns 1,000,000 iUSD in one day, they would have to send 1500 iUSD to the Stability Pool. If they don’t have them, they will have to buy iUSD.

Imagine the daily volume.

Those who have funds in the Stability Pool will have already earned with these two examples, 1500 iUSD and 3.75 ADA (minus the 2% that those who have Staking in Indigo keep). INDY STAKING REWARD: 30iUSD +0.75ADA +xx.x iBTC+ xx.x iETH.

Here’s an additional example: if someone requests 1 iBTC, they pay a 0.15% fee in ADA (they only requested it to earn APY in the Stability Pool). An hour later, the user decides to burn 1 iBTC because they regretted requesting it. In this case, the protocol will ask for an additional 0.15%, which is 0.0015 iBTC, as an iBTC fee. As the user doesn’t have this amount, they have two options: they can return less than 0.9 iBTC and keep the debt, or buy the additional 0.0015 iBTC. This will cause people to stop creating assets and will force those who are leveraged to pay a little more. However, this will not affect anyone and many could benefit, especially the INDY token and the Stability Pools.

The following image is a snapshot of how much iUSD could stabilize with this rate. By creating more interest in having synthetics, people will have more interest in having them. Pushing the price down further

- yes!! add Fees

- No, I don’t like

Adjustment to my proposal:

I initially proposed to you 0.15%, Example, setting it at 0.5%. However, if the PEG in the main DEXs with the most liquidity, like Minswap, is below or above 5%, this fee could increase up to 3%. Each increase would be staggered by 0.5% for every 5% that deviates from the PEG in the DEXs. For example:

When requesting iUSD, the fees in ADA would be as follows:

If iUSD is worth 0.97 USD, the fee when requesting a CDP would be 0.5% (base fee). If iUSD is worth 0.94 USD, the fee would increase to 1%. If iUSD is worth 0.89 USD, the fee would rise to 1.5%. When burning iUSD, the fees would be as follows:

If iUSD is worth 1.051 USD (a problem you will also face), the fee when burning would be 1%.

If iUSD is worth 1.35, the fee would increase up to 3%, which would be the fee limit. Remember that the accumulated fees of ADA and iUSD are allocated to the stability pool. To have more stable fees, they could be adjusted in each Cardano epoch. Because if the value is below 0.8 USD for just one minute, such fees should not be charged. Again, the idea is to maintain the base fee at 0.5%

- Yes, Maximum Rates 3%, with a base rate of 0.15% and a step increase of 0.15% upon loss of PEG.

- Yes, Maximum Rates 3%, with a base rate of 0.30% and a step increase of 0.30% upon loss of PEG.

- Yes, Maximum Rates 3%, with a base rate of 0.50% and a step increase of 0.50% upon loss of PEG.

- No, Best fixed fees of 0.5% 0.3% 0.5% 0.3%

- Better the initial proposal of 0.15% in Fees