Hey guys, can someone share their thoughts on the risks here and check my assumptions? Thanks for answering any one, or all of the following questions.

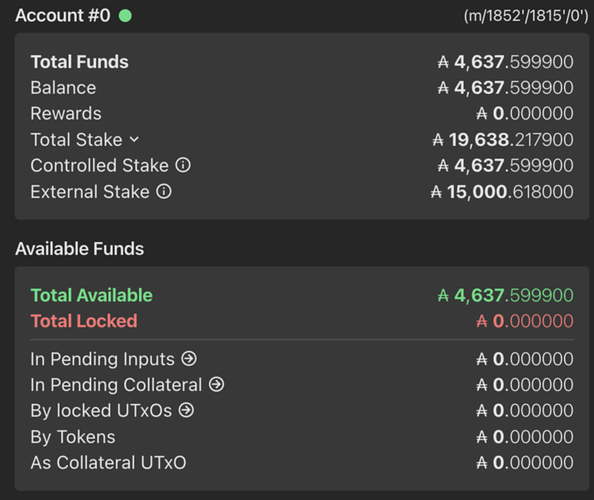

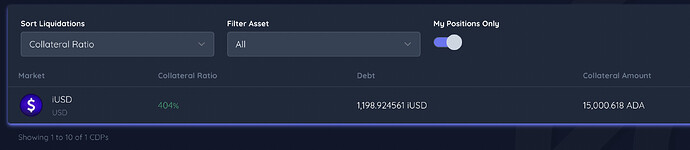

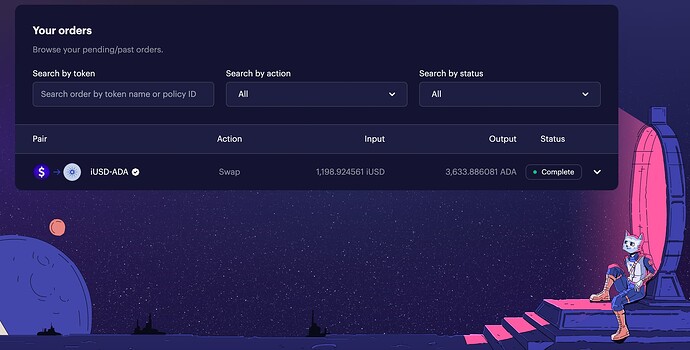

I used 15,000 ada collateral to mint about $1,200 iusd, and sold the iUSD to buy more Ada on minswap. with 400% CR I feel like the risk of liquidation is pretty low but I would like to learn more about the possibility of an oracle hack, which I know has happened on eth and other protocols. I read that while indigo protocol is audited, the oracle solution was not included in the audit. If the oracle somehow says the price of ada is 0, even if the actual price of ada hasn’t crashed, everyone gets liquidated right?

Is chainlink the oracle solution being used?

Also, what happens if iUSD somehow fails or doesn’t peg to $1. if iUSD goes to near zero, can I pay back my iusd loan at near 0 for near 0 Ada, and keep the Ada already purchased and my collateral?

assuming iUSD is 1$, what formula is used to calculate the liquidation price of my 15000 ada collateral with 400% CR?

“Liquidations can occur when CDPs become undercollateralized. Liquidations are performed by users of the protocol as well as a Liquidation Bot, operated by the Indigo Labs.” (source:Stability Pools & Liquidations - Indigo Documentation)

Question: could someone on the indigo team use this liquidation bot to steal funds (insider hack?)

If I’m liquidated, or funds somehow lost/frozen, do I loose just my 15,000 collateral or 19,638 ?

Thanks for sharing your thoughts and helping me learn about this awesome protocol.