Specifically

The Protocol Working Group (PWG) at Indigo has been collaborating with Indigo Labs and the community to boost INDY rewards and enhance liquidity. We aim to maximize iAssets impact on Cardano by redesigning liquidity incentives. We found that current ADA/iAsset rewards may not optimize iAsset benefits due to ADA redirection. To solve this, we propose shifting rewards to iAsset/iAsset pools on DEXs that support order routing. We started with SundaeSwap V3 and now will continue with Minswap V2 when launched.

Objective

Presently, our liquidity pool rewards are primarily allocated based on ADA/iAsset pairs. However, this approach inadvertently diminishes the effectiveness of iAssets incentives when 50% from the liquidity pool is ADA.

We propose shifting our reward focus to iAsset/iAsset liquidity pools. This transition allows us to capitalize on innovative order routing capabilities and reduced fees from newer DEX updates, (SundaeSwap V3 and MinSwap V2). This strategic shift is vital for enhancing iAsset utility, ensuring liquidity providers are incentivized to support Indigo Protocol’s growth and sustainability, and facilitating the expansion of new synthetics within our ecosystem.

We aim to restructure LP rewards by transitioning from rewarding ADA/iAsset liquidity pools to iUSD/iAsset LPs.

iBTC and iETH are traded against ADA, however, in the wider crypto market these assets are more traded against USD. Having it denominated in USD allows for much more correlated pricing for traders in these iAsset pools as well as reward users for the combination of various iAssets they hold.

Creating more denominations in iUSD also increases the utilities of iAssets in general and potentially open iUSD as the denomination for other assets in the space. We can align incentives more effectively with our objectives and bolster liquidity support for iAssets within the ecosystem.

To sustain iUSD/iAsset LPs effectively, we need to choose advanced DEXs that support order routing with minimal fees to avoid significant spread widening. Therefore, SundaeSwap V3 iUSD/iAssets were a successful start and now we shall continue with Minswap V2. Minswap V2 will offer a wider range of pool fees along with reduced batcher fees. It also grants more control over pool fees to the LP users.

New liquidity pools (LPs) will be created on Minswap V2 for iUSD/iBTC and iUSD/iETH. ADA/iUSD will be migrated with an updated pool fee to 0.05%.

- ADA/iUSD - 0.05% pool fee

- iUSD/iBTC - 0.25% pool fee

- iUSD/iETH - 0.25% pool fee

Scope of Changes

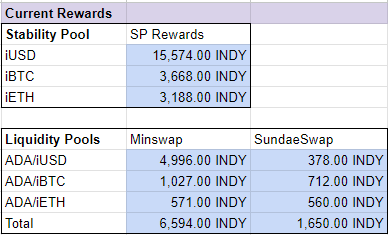

Current Rewards:

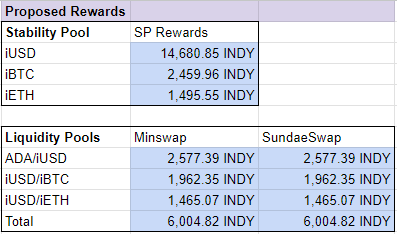

Proposed Rewards:

We propose that these rewards changes take effect once Minswap V2 has launched and the new iAsset/iAsset pools have been created.