Greetings, given the current loss of parity of iUSD with the dollar, caused by excessive self-borrowing and the increase in supply, I propose a strategy to address this situation and rekindle demand for iUSD in DEX.

Situation Analysis: Currently, the loss of parity is due to the expanded supply of iUSD by users who excessively self-borrow, with the currency not being actively acquired in DEX.

Solution Proposal:

- Focus on iUSD Demanders:

- Shift INDY rewards from the stability pool to loans on LQ Finance and Lenfi, specifically for those requesting iUSD in exchange for ADA or DJED. This will encourage leveraging and the use of iUSD.

- Specific Rewards:

- Those holding iUSD will receive interest in iUSD and LQ.

- Those requesting ADA or DJED with iUSD as collateral will earn rewards in INDY.

- Incentivize iUSD Purchases:

- Establish a temporary program that encourages the purchase of iUSD on DEX, perhaps through the distribution of INDY or other rewards to those acquiring iUSD in specified quantities.

- Continuous Monitoring and Adjustment:

- Implement a mechanism for continuous monitoring to assess the impact of these measures on the parity of iUSD. Adjust strategies as necessary to achieve long-term stability.

- Inter-Protocol Collaboration:

- Facilitate collaboration between the teams of LQ Finance and Lenfi to ensure effective implementation of these proposals and optimize results.

Special Consideration: This strategy will be implemented as a temporary solution until iUSD regains its 1:1 parity with the dollar. The goal is to provide a clear incentive to acquire iUSD and discourage excessive self-borrowing contributing to the supply increase.

Example:

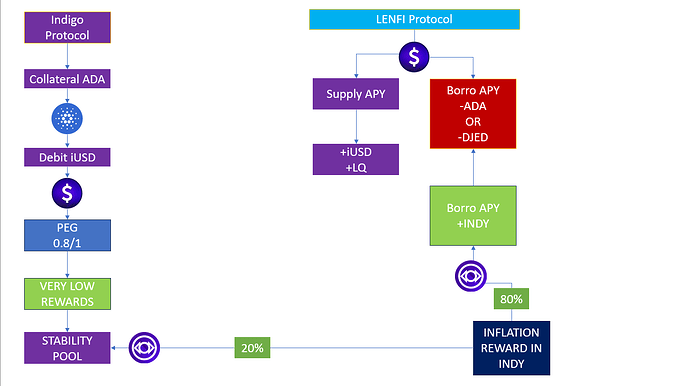

No PEG

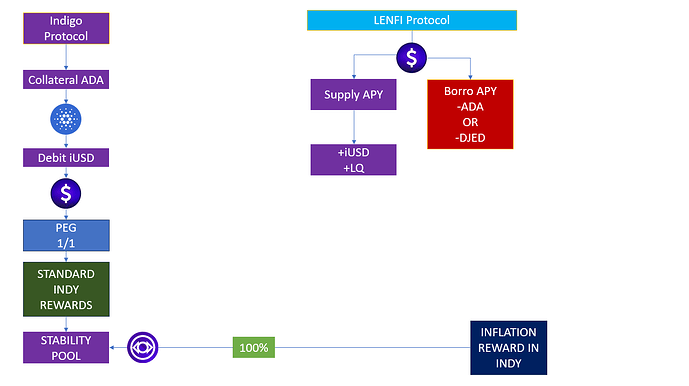

PEG

- Redirect 50% of the rewards from the stability pool

- Redirect 65% of the rewards from the stability pool

- Redirect 80% of the rewards from the stability pool

- None