With this post I would like to invite the DAO members with staked Indy to express their will and thoughts as well as suggestion on raising the withdraw tax with up to 92%.

First this temp check will determine the interest of the members on the subject and if sufficient , a vote on the percentage of increase shall be carried out.

This proposal regards the withdraw only not the unlock fee!

The reason behind my idea is the rapidly plunging value of Indy token.

This action will help defend the interest of the DAO members and will provide balance against wales withdrawing rewards sufficient to influence the price of the coin on a limited market!

If we come to an agreement the benefit of this action will lean towards the long term holders.

IMHO the solution is the Indigo adoption, not locking fees. I would not vote for this even though I am not a whale by no means.

This proposal is antithetical to a free market. I would vote against it a thousand times if I could. Disclaimer: I am not a whale by any means.

I will just bring forward an example of a benefit in favor of this proposal.

Raising the withdraw tax will definitely increase the rewards shared by the staked DAO members, will increase the stability and trust factor of Indy coin as well the participation in DAO decision making. Let me also remind you all that Indy coin is a DAO coin not an average farming coin, drastic fluctuations of any kind are not a good advertise for the future DAO members. Bottom line is would you like to be a part of something that has ever increasing value or you would rather have staked coins that are plunging all the time by the will of the more powerful participants.

In a way those who withdraw all the time will in fact leave a gratuity to those dedicated to holding and staking, those who actually participate actively in DAO and believe in this kind of governance.

This proposal is for a strategic decision which is not be refused or accepted lightly and can not be implemented without an in depth discussion. There is more than one side to everything. I have exposed part of my concerns to support my logic and I expect the same from you guys, not just simple two lines showing an opinion, please try and include more details regarding your opinion.

Thank you for participating in this topic.

A 92% fee sounds absurd, until you realize that the current APR is above 50% and adding this fee would further increase this APR.

A 92% flat fee would be far too high though, it’d discourage staking. The highest that’s reasonable to me is 5%.

In a tiered fee structure we could consider a higher fee, such as 20% fee if staked for less than a month, 5% fee if staked for twelve months, etc.

Well I did type up to 92% to provoke calculations, of course calculating reasonable number is a process of regarding the available data. By the way, where is the APY visibly printed for referral?

I never meant to sound like an idiot but I do look for reasonable discussion, therefore thank you for getting involved.

It’s not currently published anywhere

I would vote no on this so fast.

That is a bit rough …

Any chance of this getting support would probably need some sort of tier structure, higher penalty if withdrawing after a short time frame compared to a longer period. For example, tiers might range from <1 epoch through to >20 epochs.

Ok this is a fair topic to discuss, however the 92% is obv clickbait to start the discussion, but one worth having.

So reading the comments the idea of tiered came up, 1 month is 20%, 2 months 15%, etc.(just an example not real #s)

I would be in favor of something along these lines but would need more details. You don’t want people feeling like they have to lock forever so have to find a middle ground of protection.

There would not really be an increase of users by taxing 92% withdrawal fees.

There has to be an incentive for the user to risk an asset.

I would say no.

I feel a lot of hate on me coming from different sides simply for trying to express my concerns. I do not wish to continue with this as it causes me great distress. therefore I would kindly ask the moderator to put this subject into the graveyard, I will never again post anything neither in the forum nor the discord. Peace and prosperity to you all. I am out!

What about locking the exit liquidity? Making people wait about 48 hours? Because the pattern we are seeing is that whales are dumping as soon as they get rewards and then smaller fish just follow the trend. I will also be unlocking next epoch and dumping with the whales because the last two epochs are crushing us long term holders and the team is not bringing up solutions. I want to THANK YOU for at least trying to get a conversation started on this dilemma. Enjoy your break from the haters…don’t forget…haters need to hate to feel good about themselves.

Can you elaborate more on what you mean here?

As long as Indigo keeps performing. The lower prices will increase the APY from staking due to value of Indigo. That is not a bad thing because it lets the community accumulate. Don’t forget we are in a bear market. This will keep price down. Once the market opens up again. We have the ability to ride with the price.

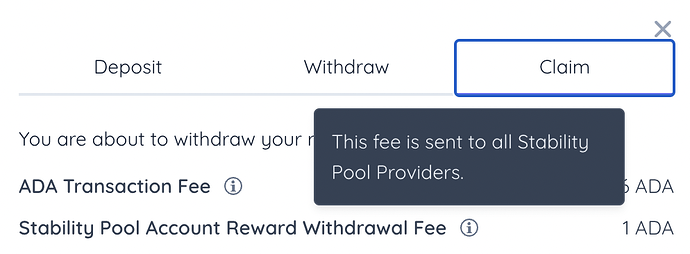

I was thinking making people wait before they exit the INDY rewards. It’s just an idea. But maybe increasing the exit fee? to 5 ada to be spread to us holders.

Love the intention, but seems you repeat yourself (for YT algo probably), and your core argument is about a guy not communicating correctly. I was into video til you started with cheap shots on someone explaining their idea.

For others - TLDView,

No taxes on exit rewards (I enjoyed the why), and DAOs suck (which I disagree)

Or did I miss something, because I won’t get back those 10:55 mins of my life BACK! And please for the love of gawd, don’t post another video you can just use 3 lines of text to answer.

Now here is a line a text we can read and walk away from “learned”, thank you!