Hello Indigo Community,

My name is Martin. I’m the SPO of ITZA, founder of Latin Stake Pools Youtube/Odysee channel for crypto educational content in Spanish and Cardano Ambassador.

I want to propose to the community the creation of three new iAssets based on commodities that have proven to be good hedges against crypto bear market. These are:

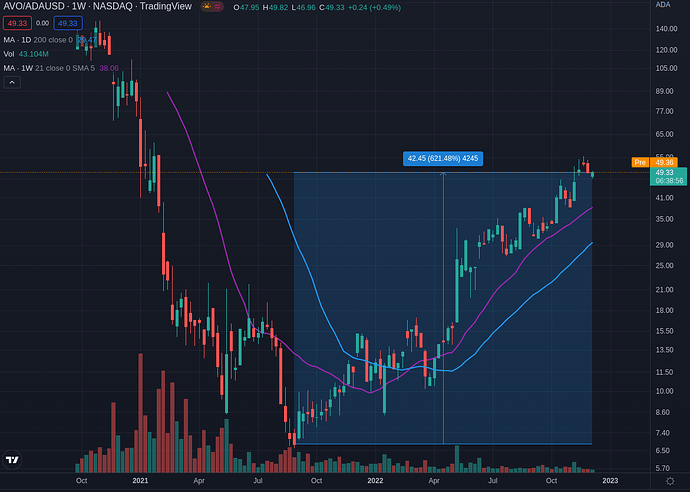

- iAVO - synthetic asset of avocado price. NASDAQ:AVO is actually a company, I’m still searching for the avocado futures ticker. If anyone knows, please comment.

- iLBS - synthetic asset of lumber futures.

- iCL1 - synthetic asset of crude oil futures.

Reasoning:

iAVO🥑

From August 2021 to date, the price of NASDAQ:AVO has appreciated against BINANCE:ADAUSD by 621.48%

While it has appreciated by 238.44% since March 2022 against INDEX:BTCUSD

(can’t post more than one image so here is the link to the rest Imgur: The magic of the Internet)

iLBS🪵

From August 2021 to date, the price of CME:LBS1! has appreciated against BINANCE:ADAUSD by 648.22%

While it has appreciated by 153.69% since November 2021 against INDEX:BTCUSD

iCL1🛢️

From August 2021 to date, the price of NYMEX:CL1! has appreciated against BINANCE:ADAUSD by 957.78%

While it has appreciated by 325.85% since November 2021 against INDEX:BTCUSD

Conclusion:

I believe that adding these iAssets would greatly benefit the RealFi ecosystem of Cardano. A lot of individuals that can’t access the USA or European financial markets don’t have the opportunity to hedge their positions with commodities. RealFi is about providing real world applications to decentralized finance and Indigo Protocol is in a great position to provide financial opportunities to a great deal of people in the margins of traditional markets.

Let me know your thoughts of this proposal. Which other commodities have proven to be good hedges against crypto bear market? Is it feasible? @EC_ATX has expressed concerns regarding the CFTC on the discord server.

Cheers,

Martin.