The advent of V2.1 gave Indigo the ability to have logarithmic interests based on the health of CDPs. Currently around 80% of iUSD liquidity is held by very few whales who seem uninterested in the large increase in interest. This situation is leading the protocol to be inaccessible for new users also due to the constant depeg of iUSD. It is becoming increasingly necessary to find a compromise with the whales and this compromise could be found through the algorithmic interest curve.

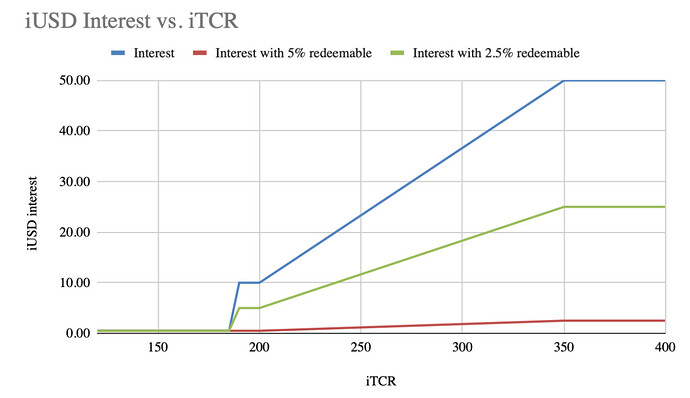

As you can see from the graph, if 5% of iUSD liquidity remained below the redemption level, the interest to be paid would be 2/3%. At this moment the RMR is equal to 185% and is considered by whales to be too risky and close to the liquidation zone, so they prefer to pay 35/40% interest rather than run the liquidation risk (right choice). For this reason it is necessary to raise the RMR by meeting the needs of the whales, giving them the possibility of holding a redeemable position without running risks (they could also decide to divide the CDP into 2, one part below the redemption level and one part above) I think an initial RMR of 250% would be in line with the current ratio and the possible bull run. To encourage this agreement, given the possible bull run upon us, I would increase the steepness of the interest curve when the ratio reaches 220%. Once the peg of iUSD has been stabilized and the interest has stabilized at suitable figures, a logarithmic RMR system based on the depeg of iUSD could be implemented.

ADVANTAGES

I see this win-win compromise:

-

iUSD would return to the peg and always have enough liquidity to maintain it, a pegged iUSD would make the protocol more attractive, give many possibilities to arbitrage bots and significantly increase trading volumes in DEXs.

-

iUSD would become the stable with the lowest interest and highest volumes, attracting new CDP users and a lot of liquidity.

-

Given an almost equal risk, whales would pay 30% less interest

-

Indy stackers would have lower interest income initially, but increased liquidity and redemption fees could offset the decrease in interest. Additionally, bots would provide a more consistent flow of commissions

-

Not only would the whales benefit from a decrease in interest, but all small users would have free access to the opening of the CDPs making the liquidity of the protocol more distributed