TL;DR

Implement an iUSD buyback program with monthly 30% of ADA currently being sent to INDY stakers.

New treasury split :

- 40% for OpEx

- 30% for INDY buyback program

- 30% for iUSD buyback program & send bought iUSD to SPs, send excess SP INDY rewards to INDY stakers

1. Implement iUSD Buyback Program

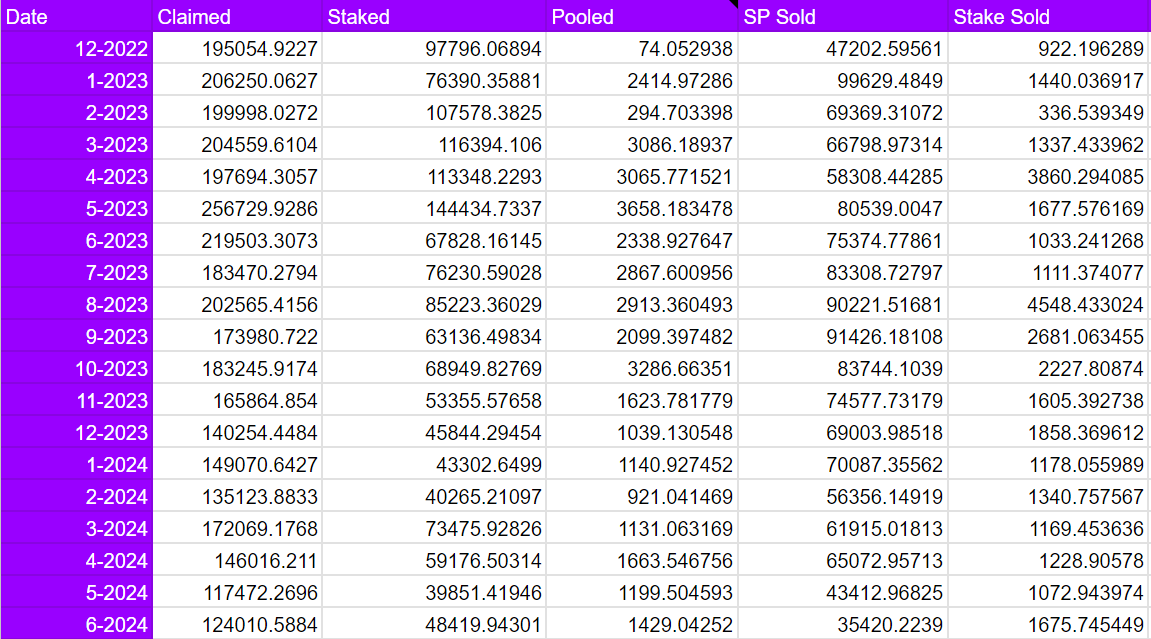

To fund an iUSD buyback program, the existing ADA sent to stakers previously approved in Proposal 53 can be instead be directed to help gain & maintain iUSD peg. At the time of this writing with current price, roughly 13,310 iUSD can be bought using the estimated monthly 30k ADA. For simplicity, this buyback program can use the existing infrastructure currently being built for the INDY buyback program.

In return, stakers receive ~50% more in total ADA value compared to receiving raw ADA.

2. Restructure Existing Rewards

Stability pools will receive the iUSD bought during the buyback program.

Sending additional rewards to stability pools would create an imbalance in rewards to SPs & INDY stakers. To counteract, a partial of INDY emissions sent to SPs would be decreased and sent to INDY stakers instead. Currently, SPs receive ~75% of INDY emissions sent to the SPs and INDY staking, with staking receiving ~25%. The updated structure will result in the emissions sent to SPs & staking to a 50% split for each.

Any ADA not used from the 30% iUSD buyback will be sent directly to SPs. This will become more common once iUSD is pegged, diminishing the need for buybacks. Partial amounts may be used to maintain peg once achieved.

Historically, the large majority of INDY rewards sent to SPs are leaving the protocol & sent to the open market, while INDY stakers have historically proven they compound the majority of rewards back into their staking positions, keeping INDY within the protocol. During this adjustment, we can take the opportunity to also balance INDY reward emissions between SPs & INDY staking.

INDY stakers will continue to receive the initial 30% ADA distribution until the iUSD buyback program is implemented. At the time of implementation, the rewards restructure detailed above will be put in place.

Rewards denominated in iUSD will be distributed each epoch, following the existing flow for INDY rewards.

Updated reward split

Estimated with 30k ADA worth of iUSD bought monthly, at current market prices. The estimated figures for SPs are also estimated given past percentage share of INDY rewards. Subject to be slightly adjusted depending on each epoch share percentage as they are normally.

| Destination | Current Daily INDY Rewards | Updated Daily INDY Rewards | Est. Daily iUSD |

|---|---|---|---|

| iUSD SP | 2938.03 | 1944.88 | 346.57 |

| iBTC SP | 493.85 | 326.91 | 58.25 |

| iETH SP | 300.97 | 199.23 | 35.50 |

| Staking | 1209.22 | 2471.04 | 0 |

Not only will the iUSD buyback program help with peg, but will help reduce INDY emissions leaving the protocol, thus assisting with the existing INDY buyback program making it more effective.

If approved, this structure will remain in place until the DAO decides a new balance is necessary between SP & INDY staking rewards.