I’d like to get some community feedback about different choices for terminology of Indigo capabilities/features.

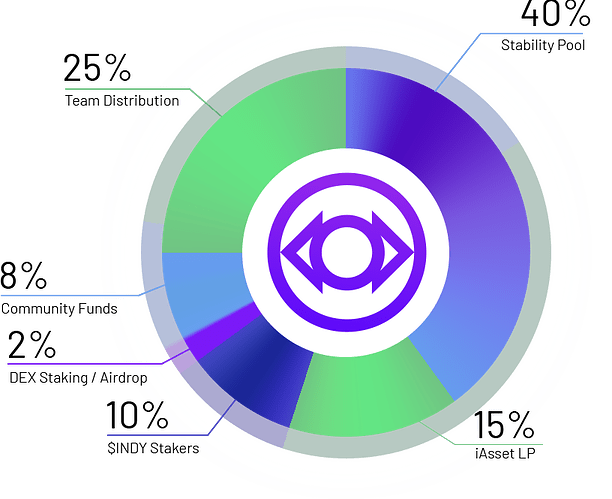

Indigo’s tokenomics currently is broken down into 6 terms:

- Stability Pool

- iAsset LP

- $INDY Stakers

- DEX Staking / Airdrop

- Community Funds

- Team Distribution

DEX Staking / Airdrop has since been renamed to Initial Token Distribution (ITD). Team Distribution remains the same but may be shortened to be simply Team. The other terms however could be changed to be more descriptive/meaningful.

Proposal 1:

Rename groups to:

- Stability Stakers

- Liquidity Proofers

- Governance Delegators

- ITD

- DAO Treasury

- Team

Terminology usage:

- Stability Staking. Stake your iAssets to an Indigo Stability Pool — earn INDY and liquidation rewards.

- Liquidity Proofing. Prove to an Indigo Liquidity Provider Pool that you’re providing iAssets as liquidity to a DEX — earn INDY as a reward.

- Governance Delegating. Delegate your INDY towards Indigo Governance proposals — earn INDY as a reward plus your share of Indigo Protocol fees.

You stake iAssets to a Stability Pool because your iAssets are at risk of loss to maintain protocol stability in exchange for compensation. You become a Stability Staker and are rewarded via Stability Staking distributions.

You prove that you’re a DEX liquidity provider either by depositing DEX LP tokens to a Liquidity Provider Pool or following instructions for one of Indigo’s partnered DEXs. You become a Liquidity Proofer and are rewarded via Liquidity Proofing distributions.

You delegate your INDY to vote for or against Indigo Governance proposals. You become a Governance Delegator and are rewarded via Governance Delegating distributions.

Proposal 2:

Rename groups to:

- Stability Stakers

- Liquidity Stakers

- Governance Delegators

- ITD

- DAO Treasury

- Team

Terminology usage:

- Stability Staking. Stake your iAssets to an Indigo Stability Pool — earn INDY and liquidation rewards.

- Liquidity Staking. Provision iAssets to a DEX and stake to an Indigo Liquidity Provider Pool — earn INDY as a reward.

- Governance Delegating. Delegate your INDY towards Indigo Governance proposals — earn INDY as a reward plus your share of Indigo Protocol fees.

You stake iAssets to a Stability Pool because your iAssets are at risk of loss to maintain protocol stability in exchange for compensation. You become a Stability Staker and are rewarded via Stability Staking distributions.

You provision your iAssets to a DEX liquidity pool and either stake your DEX LP tokens to a Liquidity Provider Pool or follow instructions for one of Indigo’s partnered DEXs. You become a Liquidity Staker and are rewarded via Liquidity Staking distributions.

You delegate your INDY to vote for or against Indigo Governance proposals. You become a Governance Delegator and are rewarded via Governance Delegating distributions.

Proposal 3:

- Stability

- Liquidity

- Governance

- ITD

- DAO Treasury

- Team

Terminology usage:

- Stability. Stake your iAssets to an Indigo Stability Pool — potentially earn INDY and liquidation rewards.

- Liquidity. Provision iAssets as liquidity to a DEX — potentially earn INDY as a reward.

- Governance. Vote on Governance proposals using your INDY — potentially earn INDY as a reward plus your share of Indigo Protocol fees.

You stake iAssets to a Stability Pool because your iAssets are at risk of loss to maintain protocol stability in exchange for compensation. You’re now providing Stability and are rewarded via Stability distributions.

You stake your iAssets to a DEX and either stake your LP tokens to a Liquidity Provider Pool or follow instructions for one of Indigo’s partnered DEXs. You’re now providing Liquidity and are rewarded via Liquidity distributions.

You stake your INDY to vote for or against Indigo Governance proposals. You’re now participating in Governance and are rewarded via Governance distributions.

Summary

Some of this terminology can be mixed and matched. Proposal 1 has the benefit of differentiating between the different types of yield generation within Indigo. Proposal 2 has the benefit of using familiar DeFi terminology. Proposal 3 has the benefit of being simple.

Please share your thoughts on which terminology you think is most appropriate.