Summary

This purpose of this discussion is to examine the interest and feasibility of using CDP interest to fund an Indigo Peg Reservoir (IPR). The IPR would be an allocation of funds that would be used to buy and/or sell iAssets on the market in a fashion that helps to maintain their peg.

Suggested parameters

-

35% of CDP interest to go toward funding an IPR

-

20% market cap limit on the treasury’s balance of any given iAsset

-

IPR will continue to be funded at the proposed rate until a DAO vote is approved to change or suspend it

Benefits of an IPR

-

Aids in achieving and maintaining iAsset peg

-

Diversifies the treasuries POL

-

Funds can be used to increase the liquidity for iAssets on DEX

-

A better peg incentivizes more users to open CDPs (ex: short sellers/ADA longs) and thereby increases the DAO’s revenue stream via the interest they pay

Changes from the Redemption Pool Temp Check

A previous Temp Check Discussion proposed the idea of a “Redemption Pool” which was a pool seeded with ADA that would be used to allow users to “redeem” iAssets that were below peg for their pegged value less some fee for use of the pool. Over 6 months have passed and between now and then and Indigo has launched their V2 platform along with a number of additions and revisions to the protocol parameters and fees. Due to the addition of interest for CDPs, the DAO now has a proper revenue stream that is able to support tools such as the pool that was outlined. As it now appears more feasible, I am re-initiating and proposing this idea along with a number of modifications:

First, the name “Redemption Pool” appeared to be a bit misleading as well as led to confusion as people thought that it might directly apply to redeeming CDPs. I will now refer to it as an Indigo Peg Reservoir or “IPR” as it is a reservoir of funds used to act as a buffer to maintain iAsset peg and the term “pool” might imply that it is a liquidity pool on an AMM (that is not necessarily how it has to be implemented).

Second, while identical to charging a fee, assets could be purchased or sold at a specified price where the “spread” between the price at which they are offered to be purchased and sold on the market can be seen as the fee charged.

Third, the purchase and resale of iAssets for the purpose of assisting in peg maintenance not necessarily occur within the same pool or strategy. We can separate the functions into two broader categories of iAsset purchases and iAsset sales/redistribution. In times that iAssets are under peg, ADA or other treasury assets can be used to either directly purchase iAssets off of the market or place bids on exchanges for purchase if price drops further. Once purchased, these iAssets can be

-

Held as part of a strategy to diversify POL

-

Used to deepen liquidity in a liquidity pool (LP) or market making (MM) strategy

-

Used in lieu of/in addition to INDY emissions to reward stability pool (SP) stakers, INDY stakers, and/or liquidity providers

Estimates

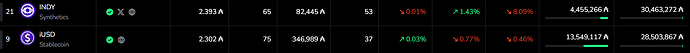

In the month and a half since v2 has launched, the DAO treasury has accumulated 85k ADA (~$38k USD) in interest as well as 1M ADA (~$450k USD) in outstanding interest. Normalized to a 30 day time span, this is roughly 56k ADA ($25k USD) in interest accrued and 667k ADA (~$300k USD) in outstanding interest per month. We may anticipate that as time goes on we can expect the proportion of accrued interest to outstanding interest to increase as CDP owners have to begin paying down their interest or adding additional collateral.

At the time of writing, iUSD is ~9% below peg, which would require ~800k ADA in immediate buy side volume across all DEX on Cardano to return to peg. This implies that with the current interest entirely going towards purchases of iUSD, these purchases might take slightly over 14 months to regain peg. As mentioned, however, we might anticipate that a more significant portion of the outstanding interest is repaid and so this “repeg timeline” would be substantially reduced. Supposing 1/3 of the outstanding interest per month turns into accrued interest per month then this would imply and accrued interest of slightly under 400k ADA/mo. At the same 100% utilization rate for iUSD purchases this reduces the “repeg timeline” to 2 months.

There are a number of broad assumptions baked into these estimates and this only includes purchases needed for the largest iAsset (iUSD). These estimates do not take into consideration additional funds needed to maintain a peg once it is achieved or maintain the peg of other iAssets, however, they also do not take into consideration markets choosing to purchase iUSD in anticipation of the DAO proactively directly pursuing a repeg with iUSD purchases. Of course, we cannot request the use of 100% of interest to pursue iAsset purchases (as this leaves no funds for other initiatives) and so it is recommended to utilize a much smaller 35% of interest funds for an IPR. This utilization rate would be more sustainable as a long term rate and allow for an actual “reservoir” of ADA to accrue in times of need for future depegs.

It is also recommended, that in the long term the DAO treasury not hold more than 20% of the supply of iAssets and they should be sold off or redistributed as incentives before that point (though this is admittedly a good “problem” to have if it were to come to that point).

Execution

An IPR would be most easily deployable on an orderbook DEX (such as Axo) where orders can be specified at a given price and partial fulfillment is allowed. A strategy can be relatively easily created that would offer bids at or just below the current market rate and an oracle can be utilized to offer asks at or near the pegged price. If market buys are the approach preferred, a DCA strategy can also be easily deployed that would purchase iAssets at a given interval. This ensures that average purchase price of iAssets is close to the average price over a given duration and also makes it difficult for bad actors to game the purchases (for example via a sandwich attack).

Alternatively, a pool could be established on an AMM (such as SundaeSwap) that allows for a dynamic adjustment of fees. The fee structure could be setup in such a way that the effective price to purchase or sell assets from/to the pool would mimic the market rate/peg price, respectively.

Finally, if IPR funds are used to only purchase iAssets (and subsequently either held or redistributed) then the process is simplified and a simple DCA order should suffice without the need to rely on an oracle for the iAsset’s peg price.