INDIGO DAO TREASURY MANAGEMENT POLICIES AND PROCEDURES

Version Two

May, 2025

Objective

Building upon the Phase One Treasury Management Proposal, Phase Two focuses on streamlining execution and enhancing INDY value accrual, ultimately guiding the protocol toward deflationary goals.

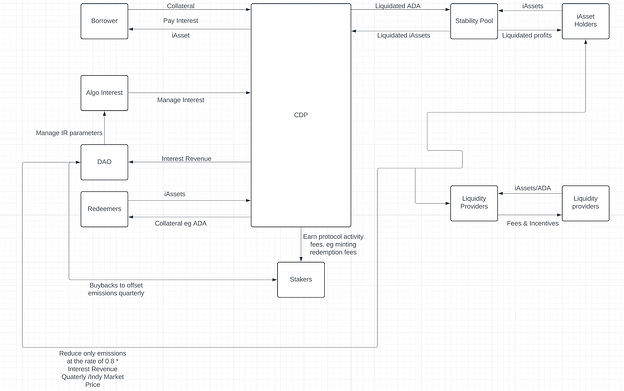

Protocol Economic Layer

Interest generated from CDP users must benefit both the Protocol and, by association, INDY holders, replenishing INDY emissions previously distributed.

Protocol stakeholders and INDY holders must align efforts to maintain protocol efficiency, attractiveness, sustainable economic activities, and consistent stakeholder value accrual.

The ecosystem’s value capture mechanism consists of four primary components:

- Treasury Withdrawals

- Buybacks Execution

- Emissions Reductions

- Staker Incentives

Treasury Withdrawal

Timely treasury withdrawals are essential for maintaining optimal economic performance. It is proposed that treasury withdrawals occur monthly.

Buybacks

Proposed Method:Time-Weighted Average Price (TWAP)

Using the “DCA” (Dollar Cost Averaging) function, this approach enables the DAO to set automated buybacks over a defined period (e.g., 30 days).

Buybacks primarily extend liquidity pool (LP) runway, facilitating governance rights accumulation and ensuring balanced stakeholder participation. Token burning may also be considered during buybacks to achieve token supply deflation.

Buybacks will be managed jointly by the PWG and the Foundation, ensuring flexibility to meet sustainability objectives.

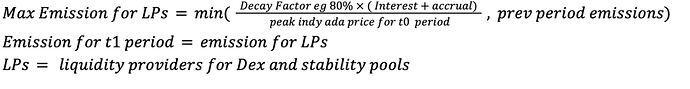

Emissions rate adjustments

To maintain the sustainability and value of emissions, a capped emission structure is recommended:

This structure ensures that emissions typically remain lower than the value generated by protocol fees. Emissions management will involve collaboration between the PWG and Foundation, enabling adaptive strategies aligned with sustainability goals.

Stakers

Stakers will continue earning INDY via staking, benefiting additionally from appreciation driven by deflationary buybacks. LP holders and other stakeholders will similarly benefit from token deflation.

Phase Two Implementation Proposal

While the guidelines above outline guides overall execution, the proposed actionable measures are as follows:

- Treasury withdrawals should occur monthly to ensure consistent operational funding.

- Treasury withdrawals will allocate 50% of funds towards buybacks, directly reducing inflation from emissions. Two buyback strategies will be deployed based on market dynamics as assessed by the PWG and Foundation:

i. Monthly TWAP Orders:

ii. Buyback Strategy 2.0 (alternative strategy as determined necessary by market conditions). - The Treasury will retain the remaining 50% of fees generated, reserved for savings and necessary expenditures.

- Emissions will be continuously monitored and reviewed monthly or upon significant market shifts. The PWG and Foundation will collaboratively manage emission allocations to ensure sustainability and avoid dilution.

- INDY staking rewards will increase from 5,000 to 10,000 INDY per epoch, replacing ADA rewards for a more predictable and consistent yield structure.

- Update the iUSD interest INDY staker portion percentage from 30% to 0%