Proposal: INDY Buyback Strategy

Summary

With the deployment of V2.1 and the DAOs decision to buyback INDY (Phase One Treasury Management), we have successfully used 309,094.00 ADA to buyback 145,379.91 INDY at an average price of 2.126112 ADA. You check these operations made from $indigo.treasury by accessing the Indigo DAO Portfolio.

The Indigo Foundation is currently responsible for executing the Buybacks as directed by the DAO in Proposal #53. After careful consideration, the PWG would like to propose a strategy to optimize the buybacks process. Since the market is unpredictable we consider it important to set up a balanced tactic to capitalize and maintain a sustainable flow of buybacks against emissions.

Context

The current process as voted on by the DAO in Proposal #53 directs the Foundation to set up Limit Orders through Sundae v3. You can view the 118 executed orders on the dApp as of 11/30/24 by accessing the DAO Portfolio.

Here are the current Buyback details directly taken from Proposal #53:

Buybacks

The DAO can vote to spend the ADA held within the Treasury for buybacks, ensuring that fees are reinvested in the protocol first. Public buybacks can be complicated due to the risk of front running and other gaming factors. A mode of execution would have to be proposed that accounts for front running or other exploits.

Proposed Method One : Floor price guarantee This method involves using order book DEXs in Cardano to place a limit order below the current INDY-ADA market price, which supports partial fills. This method provides a floor to the price of INDY, and if the price hits the target limit, the DAO would buy the INDY off-market. Large sellers can also use public buyback orders to swap INDY, reducing large volatile activities from large holders while ensuring transparency on-chain. Another benefit of this method is that it ensures that the DAO could buy back more INDY than what was emitted…

Proposed Method Two :Time-Weighted Average Price (TWAP) A second method would be to use the “DCA” function, allowing buybacks to happen over 90 days, and providing a steady and strategic approach to buybacks.

The function of quarterly buybacks against emission:

Buybacks will primarily enable the DAO to extend the runway for liquidity providers (LPs). Since LP is the main method for distributing governance rights, buybacks help maintain a balanced mix of governance stakers. Additionally, considering token burning as part of the buyback process can ensure a deflationary effect on the token supply.

Proposed INDY Buyback Strategy

The PWG will set a recommended buyback structure, currently a set of limit orders on Sundae v3 along with market orders via a Dex Aggregator. All orders are rounded down to 2 decimal places.

Buyback Fund and portion allocated to buybacks

- The ADA allocated for buybacks will accumulate in the buyback fund. At the end of each epoch, a portion of the buyback fund will be used to place buyback orders.

- This portion is calculated as the current epoch emissions multiplied by the INDY price in ADA. If the balance in the buyback fund is less than the calculated portion, the remaining ADA in the fund will be fully utilized for buyback orders.

- Any shortfall in the buyback fund for a given epoch does not impact future epochs. Each epoch operates independently, with its portion calculated based on the current emissions and INDY price.

- To ensure long-term stability and market confidence, it’s introduced limits on buyback orders to align with emissions and revenue dynamics. Orders at lower levels (-23.6% and -38.2%, amounting to 10%) remain unrestricted, while larger buybacks are deferred when emissions exceed 1.2x revenue. This approach prevents gaming and overuse of buyback funds, mitigates risks of future price corrections, and strengthens the ADA treasury, enhancing market trust.

Buyback Orders

| Percentage from Buyback Amount | Price Difference from Market |

|---|---|

| 60% | -5% |

| 15% | -10% |

| 15% | -14.6% |

| 5% | -23.6% |

| 5% | -38.2% |

- The portion amount for buyback will be placed as limit orders. Each percentage allocation (e.g., 30% of the total buybacks) will be split into multiple smaller orders, each with a maximum size of 1000 ADA, to increase the likelihood of being filled.

- Each of these orders will have an expiration date of 540 days (18 months). If an order is not filled until the expiration date, it will be cancelled, and the corresponding ADA will be returned to the buyback fund.

Example for the Buyback Strategy

Buybacks Fund: 500,000 ADA

Emissions: 30,000 INDY

INDY Price: 3 ADA

Epoch with 90,000 ADA for Buybacks (30,000 INDY x 3 ADA)

| Order Type | Buyback Amount | Execution Price |

|---|---|---|

| Limit Price at -5% | 54,000 ADA | 2.850 ADA |

| Limit Price at -10% | 13,500 ADA | 2.700 ADA |

| Limit Price at -14.6% | 13,500 ADA | 2.562 ADA |

| Limit Price at -23.6% | 4,500 ADA | 2.292 ADA |

| Limit Price at -38.2% | 4,500 ADA | 1.854 ADA |

Buyback Simulations:

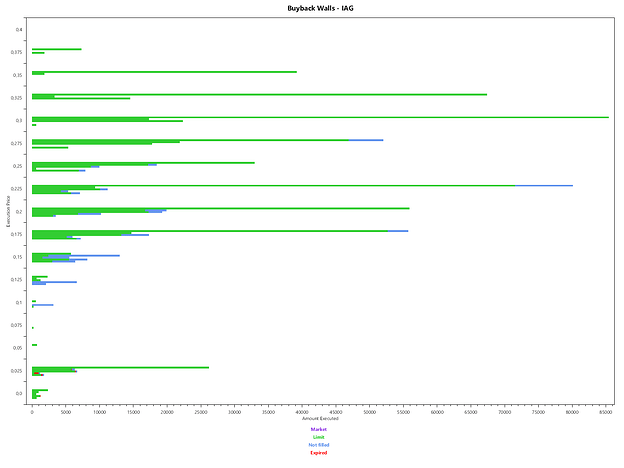

We conducted simulations to evaluate how the strategy would perform under different price action scenarios. To simulate different price trends, we used prices from INDY and other tokens. SNEK and IAG were chosen to display different scenarios, providing a model closer to reality for different market movements.

*Simulations do not account for potential price changes caused by the buyback process itself

Simulations for Buyback Behavior plotting Orders Filled, Not Filled and Expired:

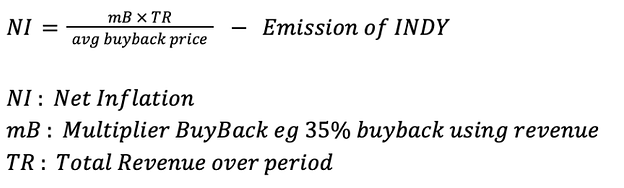

-

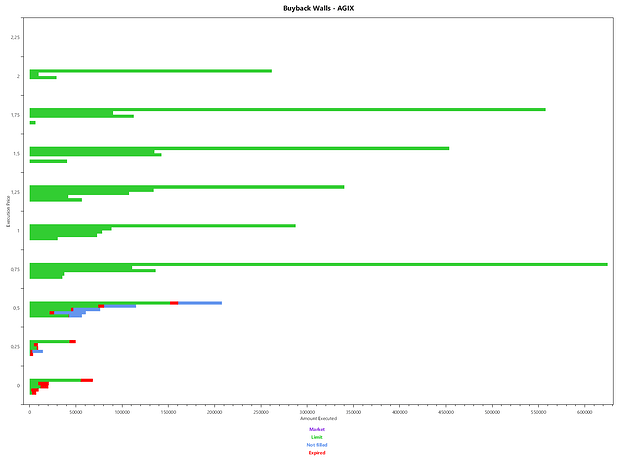

(INDY) Simulated orders placed for INDY since launch using the proposed buybacks strategy. Here you can notice several buyback walls being filled on a downtrend (green). New limit orders (blue) maintaining a wall to avoid more price corrections. Since its a downtrend all orders are being filled and none is expiring (red).

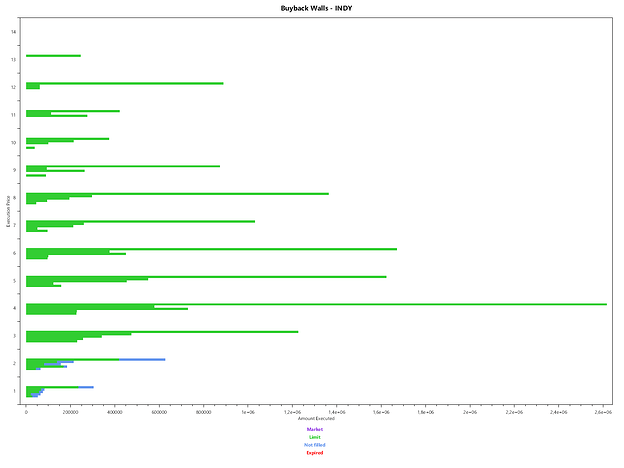

-

(SNEK) Simulated orders placed for SNEK since launch using the proposed buybacks strategy. Here we can notice several walls forming below the price (blue). Limit orders being filled on small market corrections (green). The strategy adapts to uptrends, with several orders filled at higher prices, ensuring a consistent inflow of buybacks during sustained price increases.

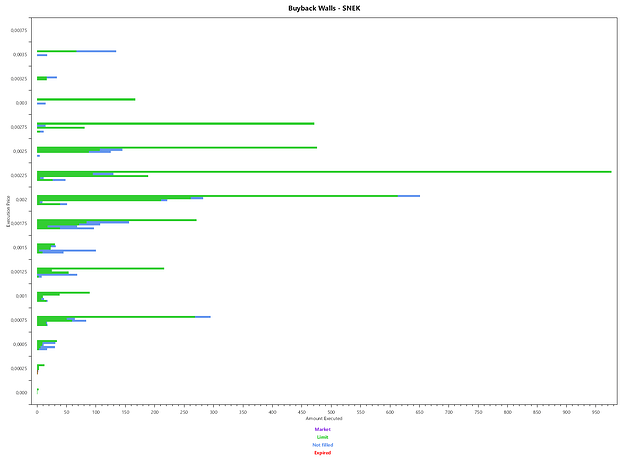

-

(IAG) Simulated orders placed for IAG since launch using the proposed buybacks strategy. Here we can notice several walls forming below the price (blue). Limit orders being filled on small market corrections (green). Lower price limit orders starting to expire (red). The strategy adapts to uptrends, with several orders filled at higher prices, ensuring a consistent inflow of buybacks during sustained price increases.

-

(AGIX) Simulated orders placed for AGIX since launch using the proposed buybacks strategy. Here we can notice several walls forming below the price (blue). Limit orders being filled on small market corrections (green). And many outdated orders from lower price levels expired (red). The strategy ensures consistent buybacks, even in volatile conditions, supporting the token effectively.

Simulations for Buyback Behavior Comparing Proposed Strategy (Closer Price Levels) and a variation for Lower Price Level Strategy, with a Focus on Alignment with Emissions Across Different Market Trends:

-

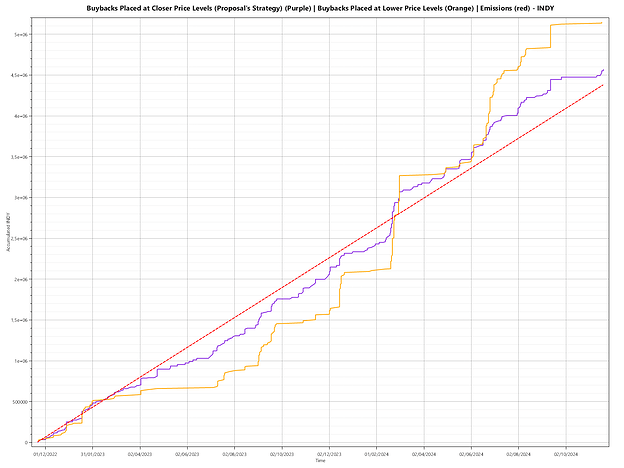

(INDY) This chart illustrates how a strategy utilizing buybacks placed at lower price levels outperforms the proposed strategy in this simulation. However, it’s important to note that this simulation does not account for the potential market impact of buybacks, which could lead to different outcomes in reality. As market trends are inherently unpredictable, it’s crucial to select a strategy that performs effectively in both uptrends and downtrends. The subsequent token used for simulations will demonstrate this adaptability. Given that INDY experienced a prolonged downtrend, the chart highlights how both strategies were able to exceed emissions, further emphasizing their effectiveness in such conditions.

-

(SNEK) This chart demonstrates the opposite behavior seen with INDY. In an uptrend, the strategy with buybacks placed at lower price levels (orange) underperforms significantly as orders fail to execute. Meanwhile, the proposed strategy (purple) closely follows emissions (red). This highlights the proposed strategy’s effectiveness in adapting to rising markets while maintaining near-emission parity.

-

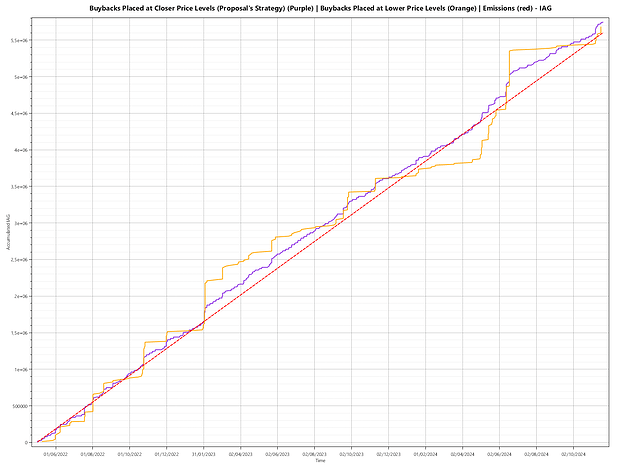

(IAG) This chart shows both strategies closely following emissions (red). However, the lower price levels strategy (orange) exhibits greater volatility due to rapid price surges and declines, while the proposed strategy (purple) maintains a more consistent and stable performance, keeping buybacks steadily above emissions.

-

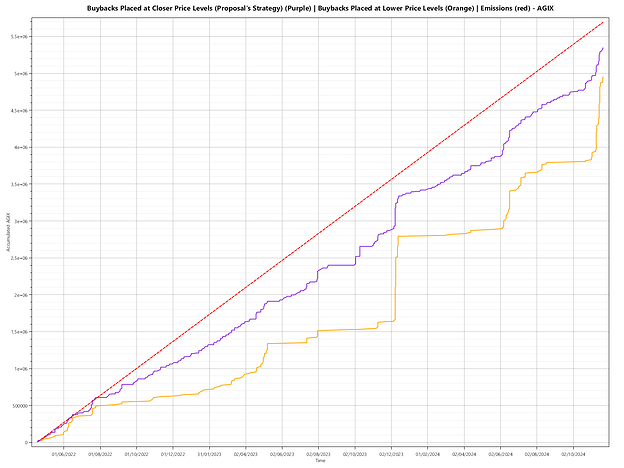

(AGIX) This chart reflects a scenario similar to SNEK, where the lower price levels strategy (orange) underperforms in an uptrend. Additionally, like IAG, it faces volatility issues due to rapid price surges and declines. In contrast, the proposed strategy (purple) remains more stable and closely aligns with emissions (red), ensuring consistent buyback performance.

Conclusion

Organized buybacks play a crucial role in countering emissions and ensuring the long-term stability of the INDY protocol. By structuring buybacks with a balanced approach, this strategy helps maintain the INDY price while preserving the treasury for future needs. The methodical execution of limit orders, along with safeguards like expiration dates and fund recycling, ensures efficient use of ADA, providing a sustainable mechanism to support the protocol’s growth and resilience over time.