Enhancing Liquidity Pool Incentives for iAssets on SundaeSwap Proposal

Specifically

The Product Working Group (PWG) at Indigo has been collaborating with Indigo Labs and the community to boost INDY rewards and enhance the Indigo Protocol. We aim to maximize iAssets impact on Cardano by redesigning liquidity incentives. We found that current ADA/iAsset rewards may not optimize iAsset benefits due to ADA redirection. To solve this, we propose shifting rewards to iAsset/iAsset pools on DEXs that support order routing, starting with SundaeSwap. We also extend our sincere gratitude to @solitude for their contribution in solidifying this idea!

Objective

Presently, our liquidity pool rewards are primarily allocated based on ADA/iAsset pairs. However, this approach inadvertently diminishes the effectiveness of iAssets incentives when 50% from the liquidity pool is ADA.

To maximize iAsset utility, we propose shifting our reward focus to iAsset/iAsset liquidity pools. This transition allows us to capitalize on innovative order routing capabilities and reduced fees from upcoming DEX updates, starting with SundaeSwap V3 and later MinSwap V2. This strategic shift is vital for enhancing iAsset utility, ensuring liquidity providers are incentivized to support Indigo Protocol’s growth and sustainability, and facilitating the expansion of new synthetics within our ecosystem.

Scope of Changes

1. LP Reward Restructuring

We aim to restructure LP rewards by transitioning from rewarding ADA/iAsset liquidity pools to iAsset/iAsset LPs. This strategic adjustment will eliminate the diversion of rewards to ADA liquidity providers and instead maximize incentives directly for iAssets.

Currently, around 50% of the rewards are redirected to ADA liquidity providers, which undermines the primary objective of incentivizing iAsset liquidity provision. By focusing rewards exclusively on iAsset/iAsset LPs, we can align incentives more effectively with our objectives and bolster liquidity support for iAssets within the ecosystem.

2. Initial DEX

To sustain iAsset/iAsset LPs effectively, we need to choose advanced DEXs that support order routing with minimal fees to avoid significant spread widening. Therefore, we propose to redirect current WingRiders rewards to new LPs in SundaeSwap.

SundaeSwap V2 already features order routing, and V3 will offer a wider range of pool fees (0% to 100%) along with reduced batcher fees. Initially, there will be a batcher fee of 0.5 ADA for the first 3 months, increasing to 1 ADA thereafter. V3 also grants more control over pool fees to the pool creator, who can set different fees for buy and sell orders, offering Indigo another potential tool for maintaining peg stability in the future.

Observation: It is noted that Minswap LP rewards will be subject to change in a subsequent proposal coinciding with the launch of Minswap V2 which will introduce order routing features.

3. Liquidity Pools and Pool Fees

New liquidity pools (LPs) will be created on SundaeSwap V3 to benefit from the new feature called Fee Manager which is the one in control of the pool fees. This responsibility will be given to PWG members and Indigo Foundation using a multi-signature mechanism and requiring the majority of members’ signatures to execute changes.

SundaeSwap (V3):

- ADA/iUSD - (New) 0.05% pool fee

- iUSD/iBTC - (New) 0.25% pool fee

- iUSD/iETH - (New) 0.25% pool fee

4. Liquidity Pools Rewards

The current rewards system (Rewards Restructure & Emissions Extension) utilizes a specific calculation to distribute rewards between two key components: SPs (Staking Providers) and LPs (Liquidity Providers). This proposal seeks to modify the rewards distribution among LPs across different DEXs starting with SundaeSwap.

Currently, rewards for ADA/iAsset LPs are distributed based on pool size. We suggest redirecting LPs rewards from WingRiders to new ADA/iUSD and iUSD/iAsset LPs in SundaeSwap. Initially the transition will hard cap the rewards division between DEXs to ensure a fair distribution, later on each DEX will receive rewards based on LPs size.

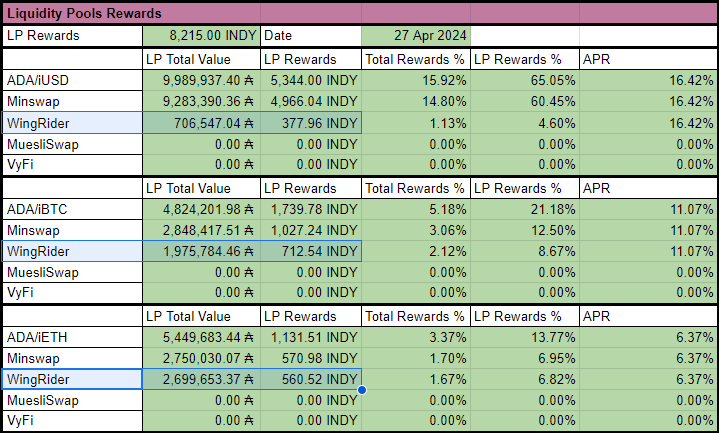

Current LPs rewards distribution, calculated on 27 April 2024:

Rewards distribution to SundaeSwap, based on the ~8215 INDY per Epoch calculated on 27 April 2024:

New LPs rewards on SundaeSwap:

- ADA/iUSD - 4.60% or ~378 INDY per Epoch

- iUSD/iBTC - 8.67% or ~712 INDY per Epoch

- iUSD/iETH - 6.82% or ~560 INDY per Epoch

Implementation Strategy

1. Initial Reward Transition

During the initial transition phase, rewards will be hard-capped based on specified divisions between DEXs. After a 2-month period (equivalent to 12 epochs), LP rewards will be distributed based on the size of LPs on each DEX. This approach ensures a measured and balanced adjustment, allowing time for market adaptation while eventually aligning rewards with liquidity contributions across DEX platforms.

2. Incentivization of New iAssets

Encourage rewards for iUSD/iAsset LPs for new iAssets, facilitating the expansion of synthetics within the ecosystem. It’s important to note that the incentivization of new iAssets using INDY rewards will be subject to a vote on-chain.

Conclusion

This proposal outlines a strategic shift in LP incentivization within the Indigo Protocol, aiming to optimize rewards for iAssets through iAsset/iAsset LPs on leading DEX platforms. By embracing order routing and lower fees, we seek to enhance liquidity provision and foster the growth of synthetic assets within the Cardano ecosystem.

Please let me know if there are any additional details or specific questions regarding this proposal.