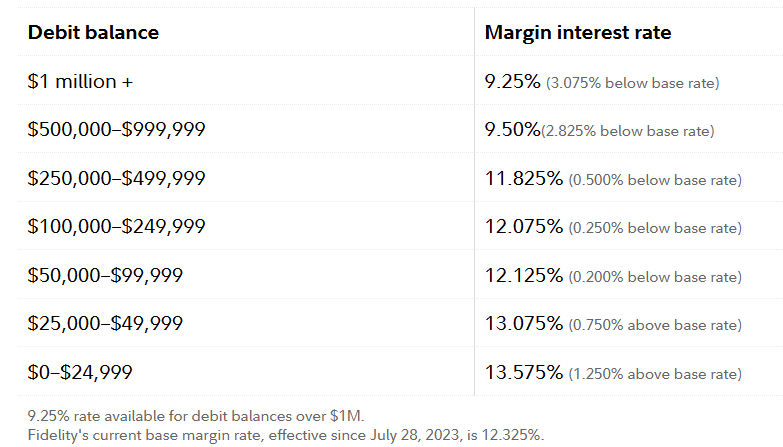

As mentioned in the example, the 1% APR / 1% iAsset value below peg was not the rate proposed, it was for an easy to digest example scenario. However, I would argue that this rate curve is far too low, not too high. 15% APR to borrow when the iAsset is depegged to quite an extreme extent ($0.85 iUSD) is quite generous, especially when you compare it to margin interest rates in traditional finance. Note that most of the time, the iAsset price should be very near the peg, so the interest rate would be much smaller in that case.

Now, the question that arises is: where will the interests that are charged now or at that time go?

That would be up to the DAO, but I’m also working on another proposal where it would go to a redemption pool to help stabilize the peg. In this way, funds generated from those who are leveraging and causing the depeg (via this interest) are going towards something that helps restore the peg.

It’s almost exactly my same proposal, but you created a compound interest debt instead of a simple fee.

Once again, it is NOT compound interest. See Investopedia for the differences between simple and compound interest.