INDIGO DAO TREASURY MANAGEMENT POLICIES AND PROCEDURES

Phase One

June, 2024

Introduction

This document outlines the strategic policies and procedures designed to ensure the long-term growth, stability, and sustainability of the Indigo Protocol. By effectively managing the DAO Treasury, we collectively aim to create a robust financial foundation that supports the protocol’s innovative initiatives and enhances value for the community.

Objective

The primary objective of the DAO Treasury is to manage assets efficiently and beneficially to achieve long-term protocol growth and reserves management. This includes maintaining a diversified portfolio to meet the protocol’s needs and mitigating operational risks.

Treasury Policies & Asset Allocation Strategy

The Treasury currently holds two primary assets: INDY tokens, which are allocated from the Token Generation Event and subsequently acquired, and ADA, the native digital asset of the Cardano ecosystem, acquired through protocol fees.

To meet the long-term needs of the protocol while mitigating operational risks, the DAO aims to balance and manage the Treasury effectively. This involves maintaining diversification and considering the types of assets to be spent from the Treasury. The core target assets deemed suitable for treasury management include BTC, ETH, stablecoins, and iAssets. The DAO may also acquire additional assets from time to time to further diversify the treasury through fee sources or token swaps.

This strategy involves balancing and managing the Treasury to meet long-term needs while maintaining diversification. We aim to:

- Allocate assets to BTC, ETH, stablecoins, and iAssets.

- Periodically review and adjust allocations based on market conditions.

Risk Management

Diversification is essential for maintaining a healthy protocol. The Treasury should not hold more than 65% of its balance valuation in a single asset. If a single asset exceeds this proportion, any required spending, investments, or divestments should consider the ratio of assets in the Treasury’s portfolio to bring it back to a balanced level. Investments in highly illiquid markets are discouraged, with a recommendation to avoid owning more than 10% of a project or participating in private sales.

Liquidity risk management will require forecasting and monitoring the availability of sufficient assets to fulfill obligations. Market risk management aims to minimize impacts on protocol continuity due to market volatility. Proper risk management will also allow the Treasury to capitalize on potential re-investment opportunities, thereby helping ensure continuity.

Redesigning Protocol Economic Layer

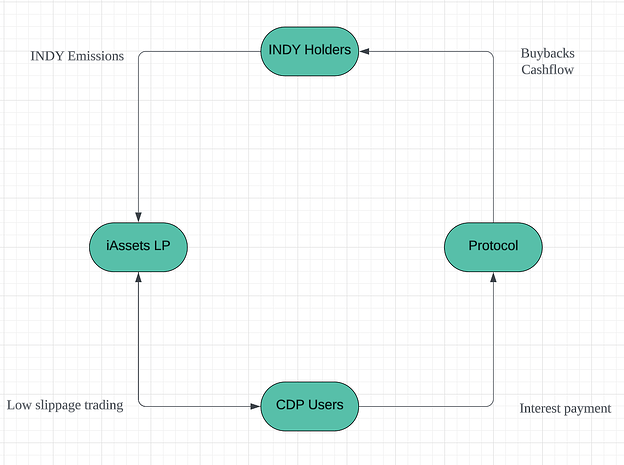

With the introduction of V2, the protocol now generates consistent fees via the introduction of interest. This helps move the protocol towards a future where liquidity pools and stability pools can fund themselves without relying on INDY emissions. However, INDY remains a core distribution mechanism, allowing iAsset holders to gain exposure to the INDY token without buying it from the market, thus diversifying the holders. This also enables core users of the protocol to amass voting rights within the ecosystem.

The interest from CDP users must ultimately benefit the protocol and, by association, INDY holders, while replenishing the INDY emissions that have been paid out. INDY holders need to ensure the protocol is run in a manner that maximizes economic activities, such as attracting CDP users while maintaining low slippage. This might involve adjusting fees like interest, minting, and stability pool fees to generate more revenue from economic activities.

Buybacks

The DAO can vote to spend the ADA held within the Treasury for buybacks, ensuring that fees are reinvested in the protocol first. Public buybacks can be complicated due to the risk of front running and other gaming factors. A mode of execution would have to be proposed that accounts for front running or other exploits.

Proposed Method One : Floor price guarantee

This method involves using order book DEXs in Cardano to place a limit order below the current INDY-ADA market price, which supports partial fills. This method provides a floor to the price of INDY, and if the price hits the target limit, the DAO would buy the INDY off-market. Large sellers can also use public buyback orders to swap INDY, reducing large volatile activities from large holders while ensuring transparency on-chain. Another benefit of this method is that it ensures that the DAO could buy back more INDY than what was emitted…

Proposed Method Two :Time-Weighted Average Price (TWAP)

A second method would be to use the “DCA” function, allowing buybacks to happen over 90 days, and providing a steady and strategic approach to buybacks.

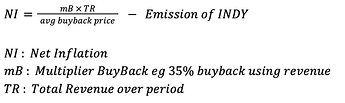

The function of quarterly buybacks against emission:

Buybacks will primarily enable the DAO to extend the runway for liquidity providers (LPs). Since LP is the main method for distributing governance rights, buybacks help maintain a balanced mix of governance stakers. Additionally, considering token burning as part of the buyback process can ensure a deflationary effect on the token supply.

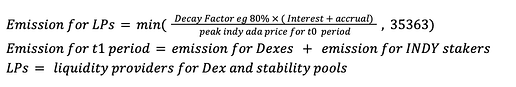

Potential Dynamic Emissions

To ensure emissions are sustained in value, the emission for the next period can be adjusted based on market conditions. For instance, during periods of rising INDY prices, emissions can be adjusted downward relative to protocol interest fees. Conversely, during falling INDY prices, buybacks can exceed emission spend, allowing the protocol to incentivize growth for the next period. This approach ensures that emission spending is mostly less than the value generated from protocol fees.

Protocol Fees Sharing

The DAO can distribute fees to INDY holders through direct distribution of any settled interest. For instance if 15% of the interest designated for stakers distribution, and the protocol received 10000 ADA, the DAO will retain 8500 ADA and INDY stakers would have 1500 ADA.

DAO Reserves

The DAO should aim to reserve a sufficient amount of ADA for operational expenses (OpEx). For example, reserving 50% of the DAO’s income is deemed necessary to ensure the protocol can sustain itself without relying excessively on INDY token spending.

Tenets of INDY, Stakers vs Holders

INDY has seen its circulating supply increase by multiple folds. In V1, most protocol fees were directed to INDY Stakers. However, it is crucial for INDY stakeholders to align with long-term protocol value rather than short-term interests, as misaligned incentives can lead users to exit the ecosystem. Fee sharing can become unsustainable in deteriorating market conditions.

With V2, the protocol is better equipped to manage fees relative to emissions. As the DAO continues to build up the treasury, it will provide longer-term value to holders. The goal is to achieve a balanced emission rate while INDY stakers continue to benefit from fees generated by protocol activities such as minting, redemption, and liquidation.

The role and objectives of the INDY governance token are as follows:

- Maintain stability and usability of the protocol through parameter adjustments

- Promote the growth of the protocol’s economic activities when possible

- Achieve sustainability for the protocol.

- Facilitate future developments for the protocol

Phase One Proposal

In the first phase, 30% of the treasury will be earmarked for buybacks to ensure stability. The treasury will retain 40% of the generated fees for expenditures, and 30% of the interest will be allocated to fee sharing as it becomes realized. This approach will apply prospectively upon the proposal’s passing, with no retroactive application. The distribution to INDY stakers will take the form of a proposal to spend from the treasury on a monthly basis.

Phase Two and beyond

Future phases will adjust the ratios based on protocol needs and market conditions. The DAO will need to pass new proposals to make these adjustments, ensuring continuous improvement and adaptation of treasury policies as the protocol evolves.

Update 21 June 2024

The proposal has been updated with changes to the following:

- Protocol fee sharing updated due to technical feasibility.

- Phase One Proposal updated on distribution methodology.

Update 2 July 2024

The proposal has been updated with changes to the following:

- Phase One Proposal updated on allocation between Stakers, Opex and Buybacks.