So we seem to be in agreement that liquidity will leave once APRs have decreased from LBE ending. You

say you want to use the unclaimed indy for revenue generation by letting the DAO use it to provide the liquidity and farm. This is well and good, however, the dao wont have access to any of these funds for a minimum of 6 months since they will be locked up in our treasury wallet. Another point to make to this, I’d assume you mean we “Zap” the indy into the pool since the treasury doesn’t have the ada marry to the indy directly…

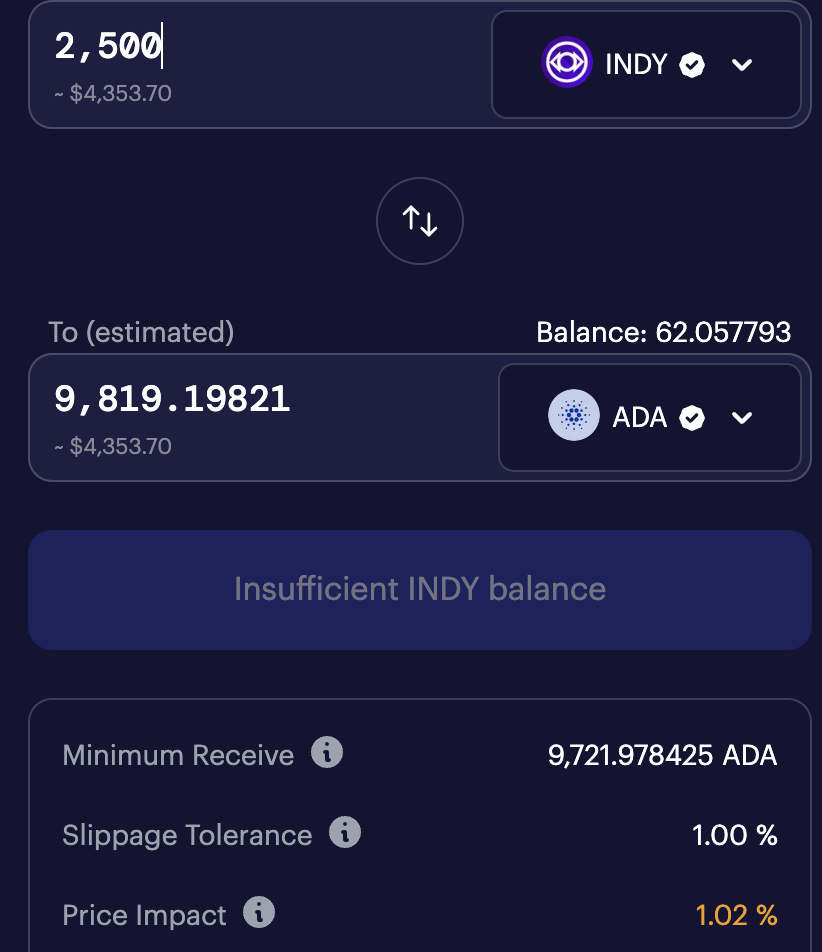

So even with today’s numbers… selling 2500 indy has a 1%! price impact. This is before liquidity has even left the pool and all the extra unclaimed indy gets accumulated while we wait to get access to the Treasury. This is only a $4300usd trade that has that much effect on the liquidity pool. How can we expect adaption if the top liquidity pool doesn’t have the ability to facilitate trades of more than a few hundred ada at a time?

2 Likes